Equinor set to open world’s biggest floating wind farm in Norway

- August 23, 2023

- Posted by: Quatro Strategies

- Categories: ESG & Renewable Energy, Europe

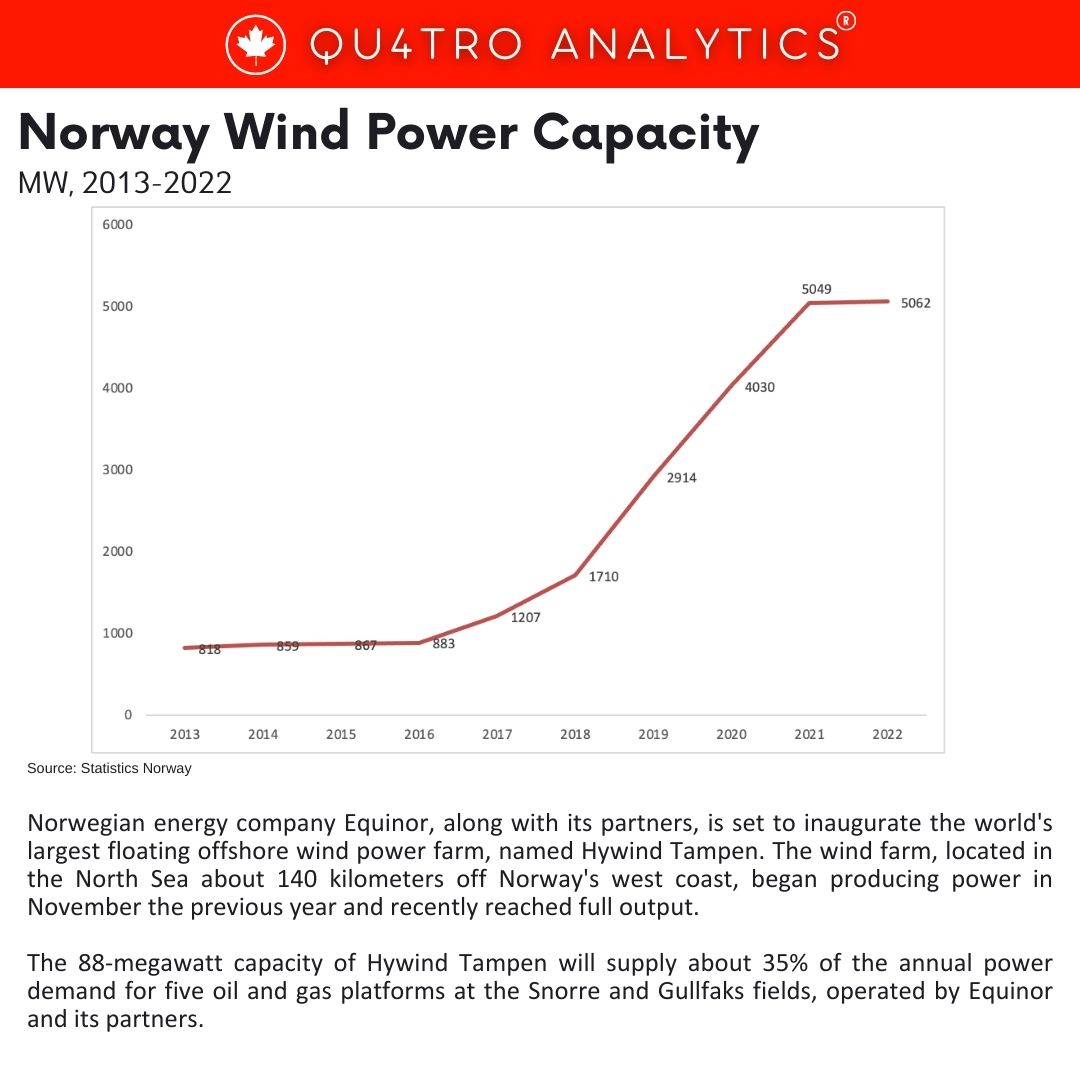

Norwegian energy company Equinor, along with its partners, is set to inaugurate the world’s largest floating offshore wind power farm, named Hywind Tampen. The wind farm, located in the North Sea about 140 kilometers off Norway’s west coast, began producing power in November the previous year and recently reached full output. The 88-megawatt capacity of Hywind Tampen will supply about 35% of the annual power demand for five oil and gas platforms at the Snorre and Gullfaks fields, operated by Equinor and its partners.

The innovative aspect of the Hywind Tampen project is its use of floating wind turbines. The 11 wind turbines are affixed to floating bases anchored to the seafloor, a technology considered suitable for deeper waters offshore. Equinor sees potential in developing this technology further for offshore wind projects in similar environments.

One of the key benefits of the Hywind Tampen wind farm is its contribution to reducing greenhouse gas emissions. By supplying renewable power to the oil and gas platforms, the project is expected to cut CO2 emissions from the fields by approximately 200,000 tonnes per year. This reduction corresponds to about 0.4% of Norway’s total carbon dioxide emissions in 2022.

One of the key benefits of the Hywind Tampen wind farm is its contribution to reducing greenhouse gas emissions. By supplying renewable power to the oil and gas platforms, the project is expected to cut CO2 emissions from the fields by approximately 200,000 tonnes per year. This reduction corresponds to about 0.4% of Norway’s total carbon dioxide emissions in 2022.

However, the project has sparked debates among environmentalists. While some view it as a positive step towards lowering the country’s carbon emissions, others argue that Norway should prioritize phasing out oil and gas production altogether.

Norway has ambitious plans for offshore wind power. The country aims to achieve 30 gigawatts of offshore wind capacity by 2040, which would double its current power output. As part of this goal, Norway plans to tender its first commercial wind farms, including three floating projects, in the upcoming months. Equinor’s partners in the Hywind Tampen project include Wintershall Dea, INPEX Idemitsu, and Norway’s Petoro.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.