ECB raises interest rate to record 4%, forecasts upward inflation for next year

- September 15, 2023

- Posted by: Quatro Strategies

- Categories: Business & Politics, Europe, Sanctions & Regulation

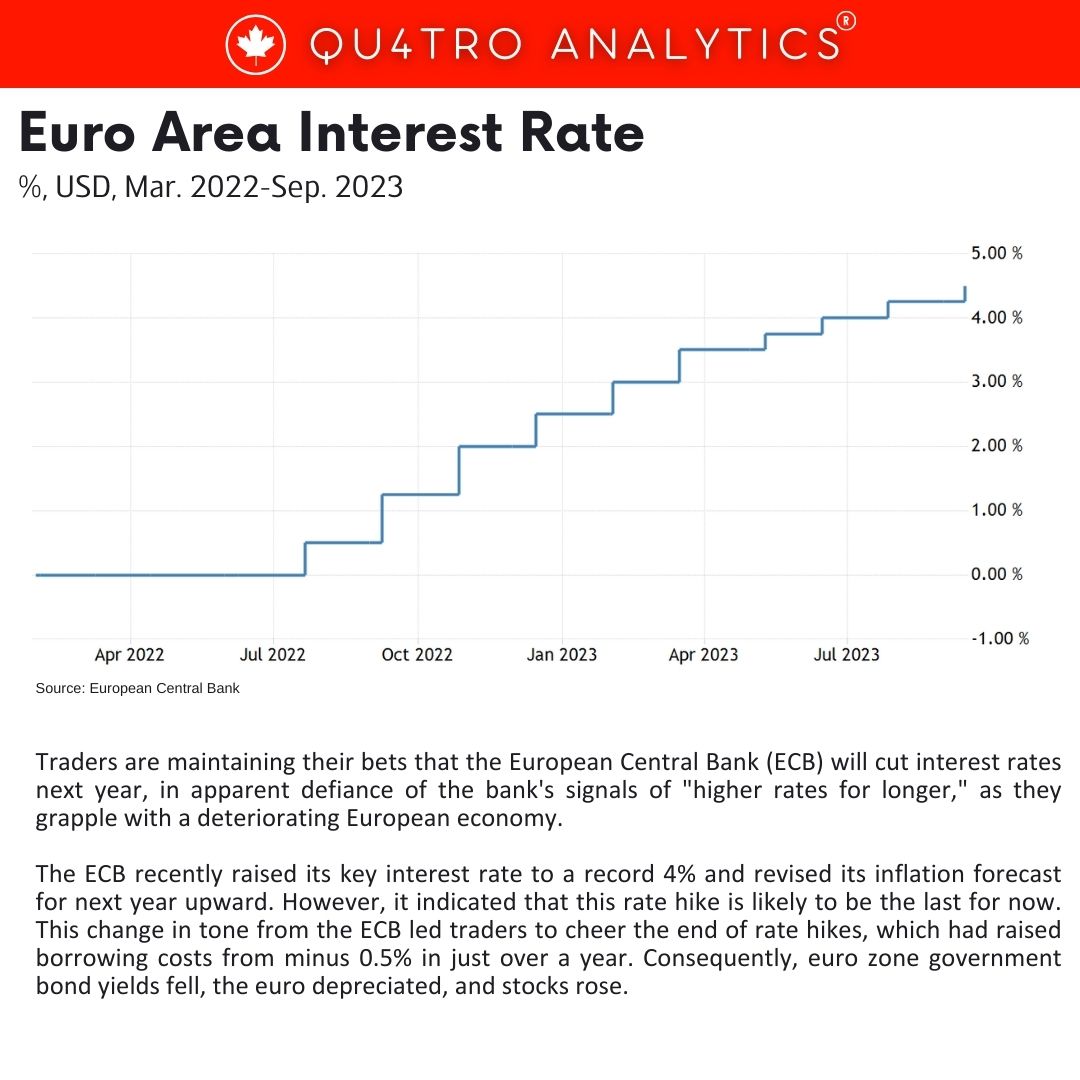

Traders are maintaining their bets that the European Central Bank (ECB) will cut interest rates next year, in apparent defiance of the bank’s signals of “higher rates for longer,” as they grapple with a deteriorating European economy.

The ECB recently raised its key interest rate to a record 4% and revised its inflation forecast for next year upward. However, it indicated that this rate hike is likely to be the last for now. This change in tone from the ECB led traders to cheer the end of rate hikes, which had raised borrowing costs from minus 0.5% in just over a year. Consequently, euro zone government bond yields fell, the euro depreciated, and stocks rose.

The primary concern for traders seems to be the state of economic growth in the euro zone, which is struggling, even though inflation remains a worry for the ECB. Traders are holding firm in their expectations of rate cuts next year, with some anticipating the first cut of 25 basis points (bps) by June.

The ECB has lowered its growth forecast for the euro area this year to 0.7%, while economists polled by Reuters expect even lower growth, at 0.6%. This disconnect between market pricing and the ECB’s growth expectations reflects traders’ skepticism about the economic outlook.

While bond and stock investors welcomed the halt to further rate hikes, it’s noteworthy that the ECB intends to maintain high rates for a “sufficiently long duration” to help reduce inflation. This implies that rates will remain elevated for an extended period.

While bond and stock investors welcomed the halt to further rate hikes, it’s noteworthy that the ECB intends to maintain high rates for a “sufficiently long duration” to help reduce inflation. This implies that rates will remain elevated for an extended period.

The market rally following the ECB’s decision might not be welcomed by the bank. A board member had previously expressed concern that market rallies amid a weakening growth outlook had undermined some of the ECB’s monetary tightening efforts.

The ECB’s pledge to continue reinvesting proceeds from the Pandemic Emergency Purchase Programme (PEPP) until the end of 2024 also played a crucial role in the bond rally. This decision provides the ECB with more flexibility in deciding where to reinvest these proceeds.

However, the optimism in the markets could be short-lived. Some hawkish policymakers have called for an earlier end to PEPP reinvestments. The ECB might also discuss further balance-sheet adjustments now that rate hikes appear to be on hold, which could impact markets.

Overall, the market’s reluctance to adjust expectations for rate cuts highlights the significant uncertainty surrounding the ECB’s future policy direction. While traders have priced in certain outcomes, extending these expectations depends on various factors and assumptions, making the outlook somewhat unclear. ECB Chief Christine Lagarde also noted that the bank didn’t explicitly say it had reached peak rates, adding to the ambiguity in interpreting its stance.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.