OPEC output cuts push fuel prices, inflation up

- September 18, 2023

- Posted by: Quatro Strategies

- Categories: Business & Politics, Middle East, Oil & Gas, United States

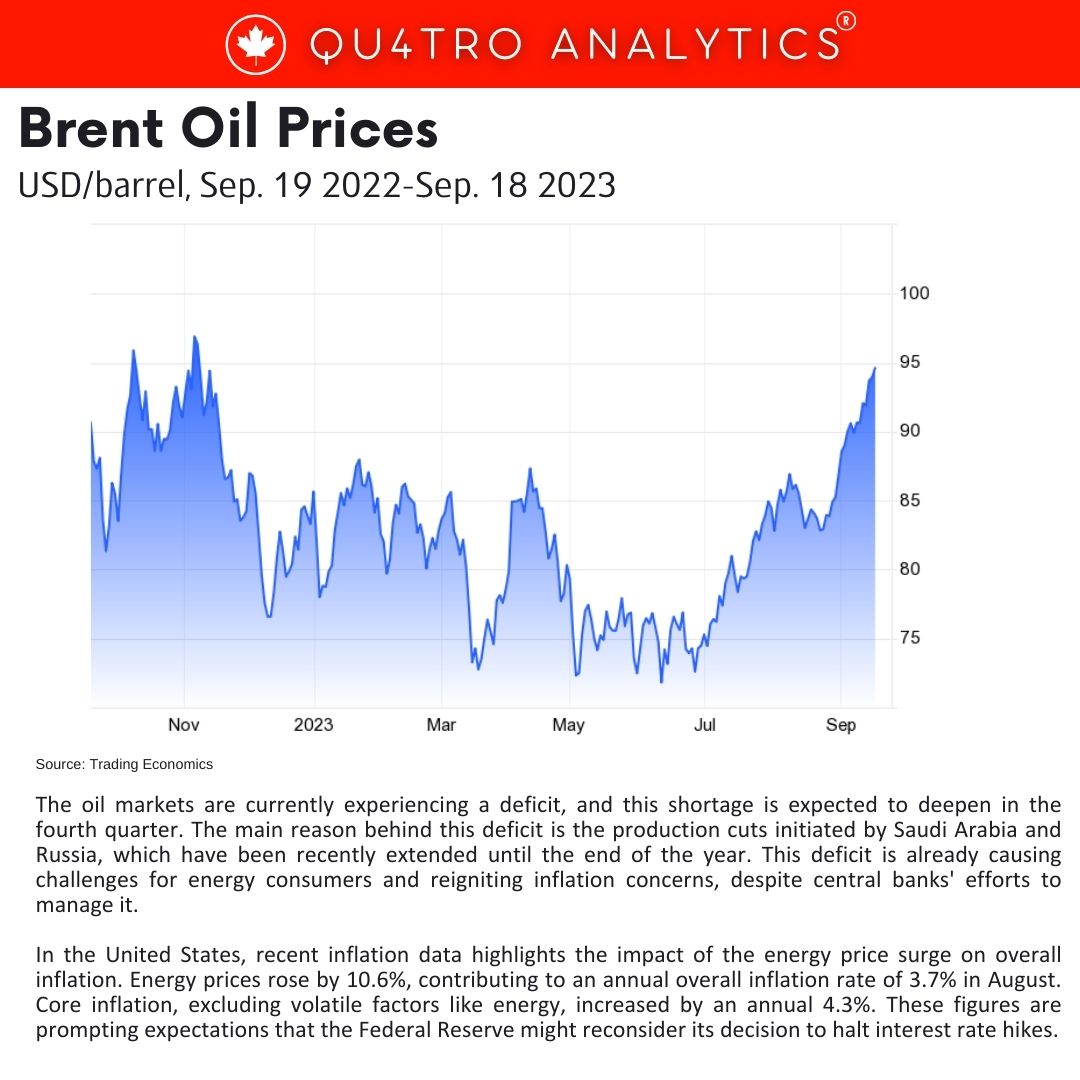

The oil markets are currently experiencing a deficit, and this shortage is expected to deepen in the fourth quarter. The main reason behind this deficit is the production cuts initiated by Saudi Arabia and Russia, which have been recently extended until the end of the year. This deficit is already causing challenges for energy consumers and reigniting inflation concerns, despite central banks’ efforts to manage it.

In the United States, recent inflation data highlights the impact of the energy price surge on overall inflation. Energy prices rose by 10.6%, contributing to an annual overall inflation rate of 3.7% in August. Core inflation, excluding volatile factors like energy, increased by an annual 4.3%. These figures are prompting expectations that the Federal Reserve might reconsider its decision to halt interest rate hikes.

The Wall Street Journal recently reported that industries heavily reliant on hydrocarbons, such as construction, transport, and farming, are facing challenges due to higher fuel prices, especially diesel. Electric alternatives for diesel-fueled trucks have not yet reached a scale, cost, and range that would make them viable options for these industries.

The surge in gasoline prices is primarily tied to the recent increase in crude oil prices. On the other hand, the situation with diesel fuel is more concerning. Global inventories of middle distillates, which include diesel, heating oil, and gasoil, are considerably lower than usual for this time of the year. The shortage is exacerbated by insufficient refining capacity and a lack of sour crude.

In the United States, distillate fuel inventories were 16% lower than the ten-year seasonal average in August, amounting to a deficit of 23 million barrels. Europe is facing a similar situation, with middle distillate inventories being 8% lower than the ten-year average for August, a deficit of 35 million barrels.

In the United States, distillate fuel inventories were 16% lower than the ten-year seasonal average in August, amounting to a deficit of 23 million barrels. Europe is facing a similar situation, with middle distillate inventories being 8% lower than the ten-year average for August, a deficit of 35 million barrels.

The scarcity of refineries is a significant problem, particularly in Europe and North America. Many refineries were closed during the pandemic, and some were converted to biofuel production plants. The remaining capacity is primarily suitable for gasoline production, not enough to meet the demand for diesel fuel and other middle distillates.

This situation implies that the challenges experienced by U.S. construction companies and European freight transport firms due to rising fuel prices are likely to persist and potentially worsen as the heating season approaches, increasing demand for fuel oil.

Not only businesses but also the Biden administration is concerned about rising gasoline prices. However, options to address this issue are limited. The strategic petroleum reserve is already at a 40-year low, making massive drawdowns challenging. Producers are not likely to ramp up production quickly, and even if they do, it won’t address the specific shortages in sour, heavy crudes used in distillate fuel production.

In conclusion, the energy market’s imbalance, driven by production cuts and refinery limitations, is leading to a deficit that affects consumers and economies worldwide. Addressing this issue requires a multi-faceted approach, including strategic energy production, refining capacity enhancement, and exploration of alternative energy sources to ensure a more stable and sustainable energy future.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.