Chinese EV maker BYD making serious headways in Southeast Asia

- September 19, 2023

- Posted by: Quatro Strategies

- Categories: Asia Pacific, China, EVs & Battery Technology

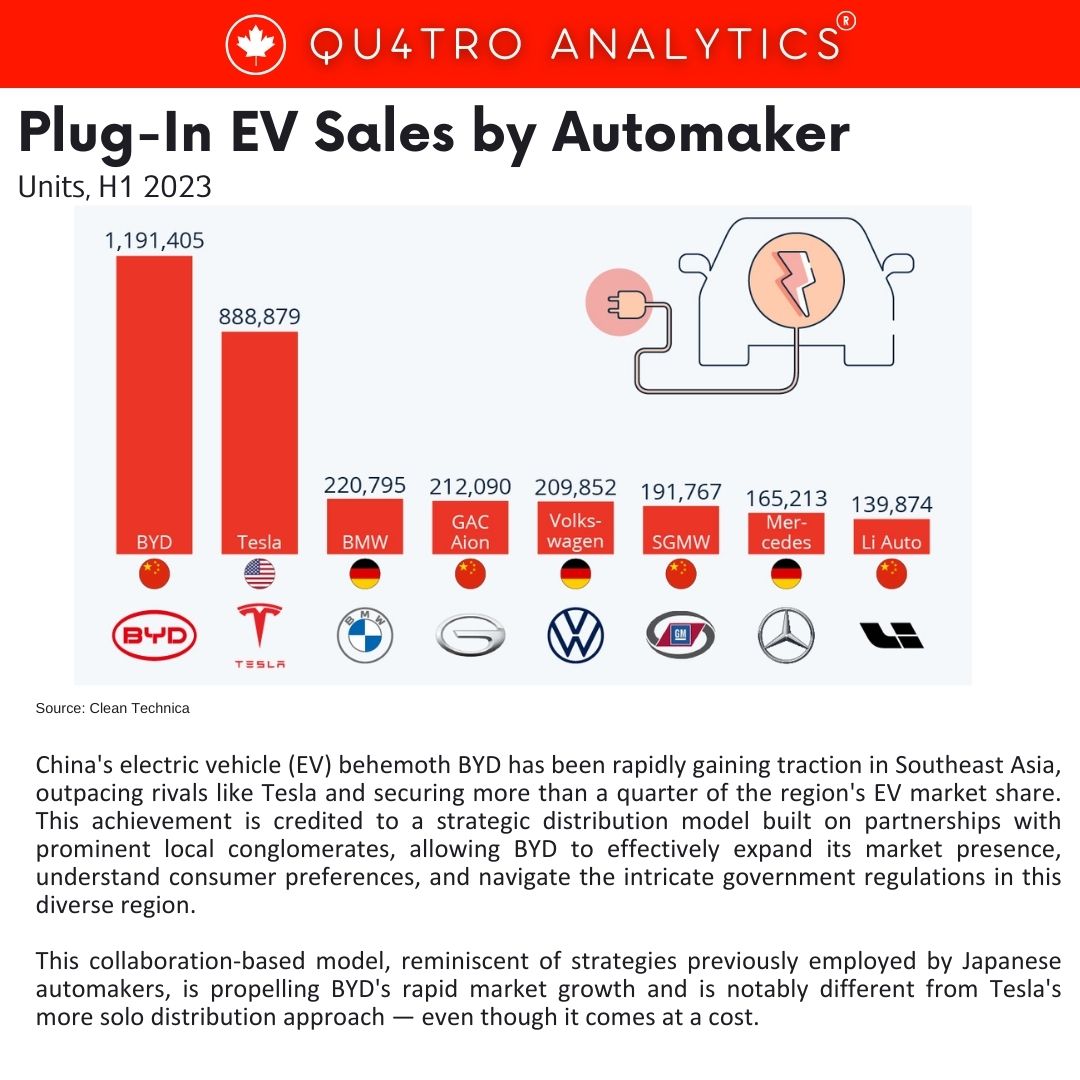

China’s electric vehicle (EV) behemoth BYD has been rapidly gaining traction in Southeast Asia, outpacing rivals like Tesla and securing more than a quarter of the region’s EV market share. This achievement is credited to a strategic distribution model built on partnerships with prominent local conglomerates, allowing BYD to effectively expand its market presence, understand consumer preferences, and navigate the intricate government regulations in this diverse region. This collaboration-based model, reminiscent of strategies previously employed by Japanese automakers, is propelling BYD’s rapid market growth and is notably different from Tesla’s more solo distribution approach — even though it comes at a cost.

Presently, BYD is focusing more on brand proliferation than on optimizing profit margins. This strategy involves offering local dealers more attractive profit margins, fostering trust and loyalty that sets the stage for extensive expansion. This approach allows BYD to build its market share swiftly, even if it potentially impacts immediate profitability.

In the second quarter of 2023, BYD commanded more than 26% of all EV sales in Southeast Asia. Its Atto 3 model, priced starting at $30,000 in Thailand, emerged as the regional bestseller, providing a compelling alternative to Tesla, whose most basic Model 3 is priced at approximately $57,500 in Thailand.

The EV segment accounted for 6.4% of all passenger vehicle sales in Southeast Asia in the second quarter. Following the European Commission’s investigation into Beijing’s EV subsidies, the region is gaining prominence for Chinese automakers, making BYD’s growth trajectory especially promising.

BYD has forged partnerships with crucial regional distributors, including divisions of Sime Darby, Bakrie & Brothers, Ayala Corp, and Rever Automotive. These partnerships have played a pivotal role in helping BYD establish itself in Southeast Asia, where Chinese car brands historically lacked a well-established track record.

BYD has forged partnerships with crucial regional distributors, including divisions of Sime Darby, Bakrie & Brothers, Ayala Corp, and Rever Automotive. These partnerships have played a pivotal role in helping BYD establish itself in Southeast Asia, where Chinese car brands historically lacked a well-established track record.

The strategy provides potential buyers with a sense of reassurance, particularly regarding aftersales support, by aligning with established players. Notably, BYD is investing nearly $500 million in Thailand to construct a new factory, showcasing its commitment to the Southeast Asian market.

While Tesla adopts a direct-to-consumer approach, BYD’s embrace of dealerships, partnerships, and strategic branding initiatives distinguishes its market strategy. For example, in Singapore, BYD has partnered with Sime Darby Motors to establish showrooms that double as restaurants, offering a unique space to engage with tech-savvy consumers and bolster the brand’s presence.

Through these strategic moves, BYD is well-positioned to challenge Tesla’s dominance and expand its influence in Southeast Asia’s burgeoning EV market. This collaborative strategy, though potentially affecting short-term profitability, provides a foundation for sustainable growth and broad market penetration.

By QUATRO Strategies International Inc.

QUATRO Strategies International Inc. is the leading business insights and corporate strategy company based in Toronto, Ontario. Through our unique services, we counsel our clients on their key strategic issues, leveraging our deep industry expertise and using analytical rigor to help them make informed decisions to establish a competitive edge in the marketplace.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.