Chinese copper demand slowing down at a time when it normally sees an uptick

- September 19, 2023

- Posted by: Quatro Strategies

- Categories: China, Mining & Metals, Rare Earths & Commodities

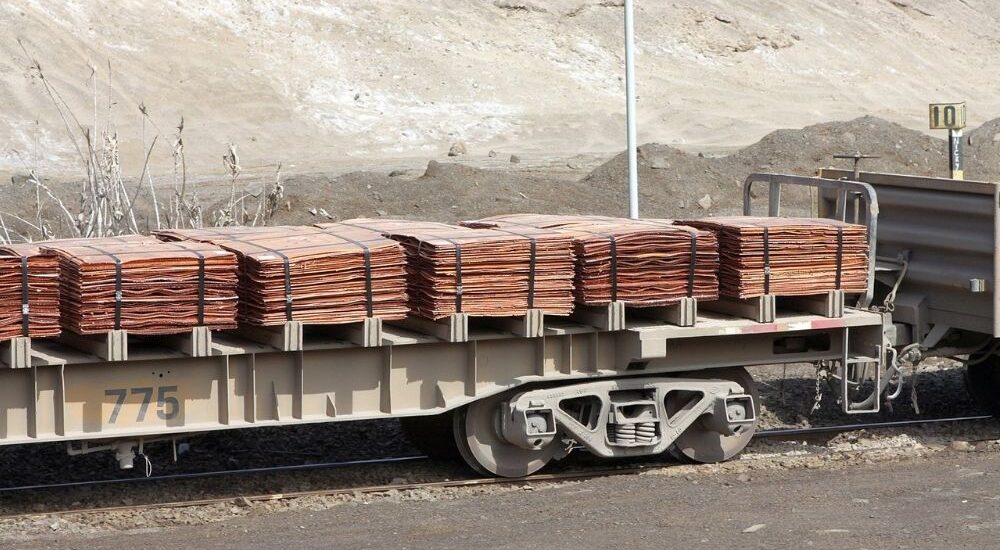

Copper demand in China, the world’s largest consumer of the metal, is experiencing a slowdown during a period that traditionally sees an uptick in demand. The copper market, usually a barometer of economic health, is seeing some support from the global energy transition and Beijing’s efforts to boost growth. However, consumer caution and suppressed margins are hindering a robust rebound in demand. China’s recovery from the pandemic has lost momentum, and while recent government measures have stabilized the economy, reports of lackluster demand are concerning, especially during the typically busy autumn period for copper fabricators in China.

Copper prices have been trading in a narrow range for months, reflecting the lack of momentum in China’s recovery. About a quarter of China’s copper demand comes from the construction sector, which has been significantly impacted by the prolonged crisis in the property market.

Consumer goods, accounting for 16% of copper demand, have also suffered as households have become more cautious due to economic uncertainty. On the other hand, power generation, transmission, and storage, making up 20% of demand, have seen growth, particularly in renewable energy and electric vehicles as China focuses on green initiatives.

Refined copper demand grew by 6.3% in the first half of the year, primarily driven by clean energy and appliances like air-conditioners. However, demand growth is expected to slow down in the second half of the year, potentially fading to 3.9% as China’s solar expansion slows and households reduce purchases.

This outlook suggests that the autumn peak season might disappoint. While copper fabricators have increased production, it hasn’t been accompanied by rising orders, indicating a lag in demand from end-user segments. Spot trading is satisfactory, but consumption is lagging, and premiums are falling.

The property sector, a major consumer of copper, is facing a prolonged crisis, and renewable energy, although growing, is not yet substantial enough to drive a significant difference in copper demand. For the first seven months of the year, Chinese base metals smelters and processors recorded their worst cumulative drop in profitability in over a decade.

Without more aggressive stimulus from Beijing, China’s economy might enter a phase of slower growth. Government policy support is currently stimulating demand, but there’s a need for more spontaneous consumption from consumers to drive sustained growth in the copper market in China.

By QUATRO Strategies International Inc.

QUATRO Strategies International Inc. is the leading business insights and corporate strategy company based in Toronto, Ontario. Through our unique services, we counsel our clients on their key strategic issues, leveraging our deep industry expertise and using analytical rigor to help them make informed decisions to establish a competitive edge in the marketplace.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.