Shell will supply natural gas to Trinidad’s national oil company

- September 25, 2023

- Posted by: Quatro Strategies

- Categories: Americas, Oil & Gas

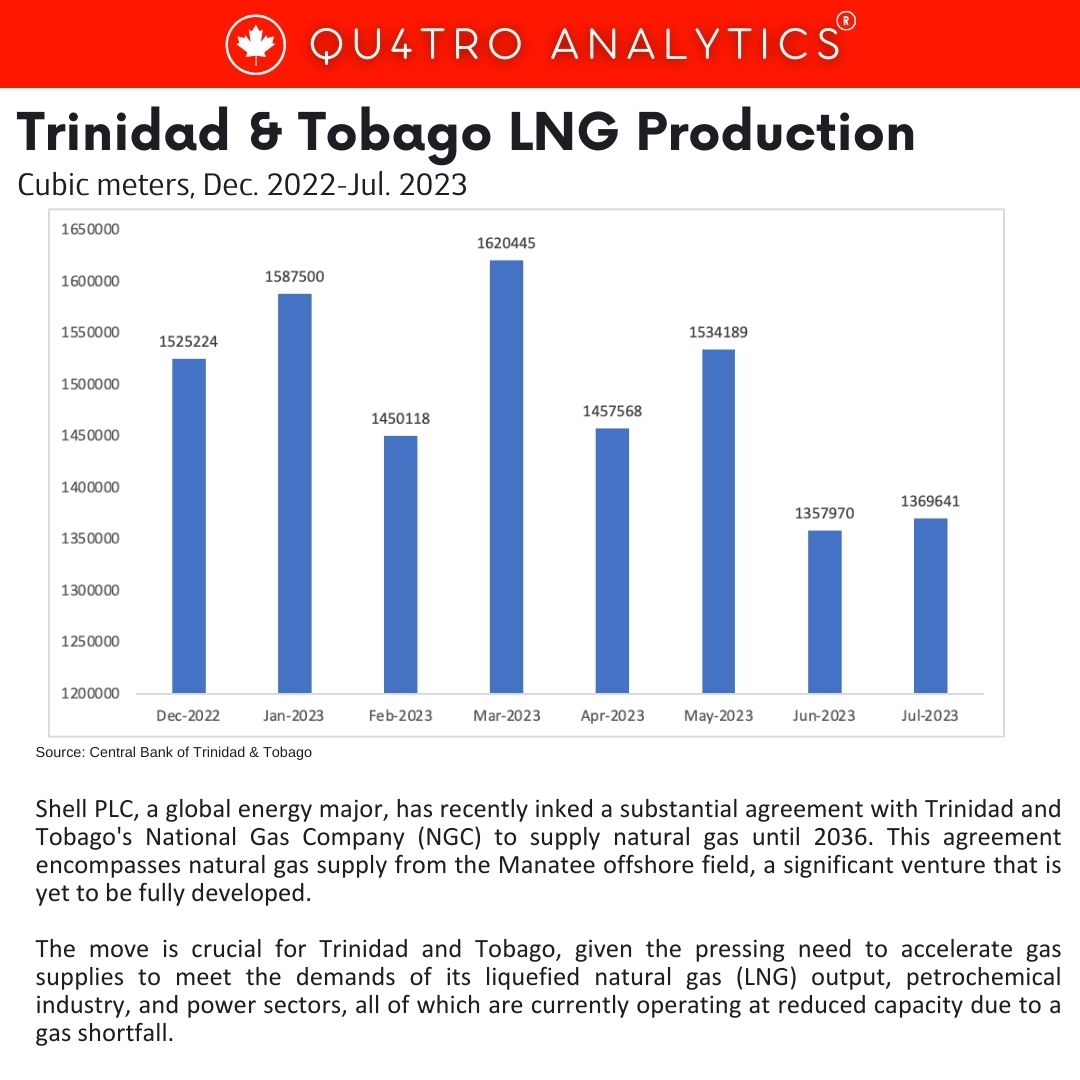

Shell PLC, a global energy major, has recently inked a substantial agreement with Trinidad and Tobago’s National Gas Company (NGC) to supply natural gas until 2036. This agreement encompasses natural gas supply from the Manatee offshore field, a significant venture that is yet to be fully developed. The move is crucial for Trinidad and Tobago, given the pressing need to accelerate gas supplies to meet the demands of its liquefied natural gas (LNG) output, petrochemical industry, and power sectors, all of which are currently operating at reduced capacity due to a gas shortfall.

Under this agreement, Shell commits to providing NGC with a minimum of 150 million cubic feet per day (mcfd) of natural gas from the Manatee offshore field. The Manatee field is part of the shared Trinidad-Venezuela Loran-Manatee discovery, which is estimated to hold a vast reserve of approximately 10 trillion cubic feet (TCF) of natural gas.

NGC President Mark Loquan emphasized the significance of the Manatee field for Trinidad and Tobago, stating that it represents a substantial resource for the country. He also expressed optimism about bringing this project to fruition, acknowledging the journey ahead to access gas from the Manatee field.

The Manatee offshore field is projected to start providing gas in 2028. It is expected to produce up to 700 mcfd, with a substantial portion allocated to LNG production and the remaining gas designated for sale to NGC, specifically for the petrochemical sector.

The Manatee offshore field is projected to start providing gas in 2028. It is expected to produce up to 700 mcfd, with a substantial portion allocated to LNG production and the remaining gas designated for sale to NGC, specifically for the petrochemical sector.

Moreover, the agreement stipulates that if NGC cannot accept the daily contracted volume, it would still be required to pay for 50% of the agreed 150 mcfd of gas. Additionally, Shell has agreed to transport the gas to NGC’s Beachfield facility, allowing NGC to enhance value by processing the liquids derived from the Manatee field.

This agreement between Shell and NGC is a crucial step forward, demonstrating Shell’s commitment to partnering with the Government of Trinidad and Tobago. It signifies a strategic move to bolster gas supplies, which are instrumental for the growth and sustainability of the country’s vital industries, including LNG, petrochemicals, and power.

By QUATRO Strategies International Inc.

QUATRO Strategies International Inc. is the leading business insights and corporate strategy company based in Toronto, Ontario. Through our unique services, we counsel our clients on their key strategic issues, leveraging our deep industry expertise and using analytical rigor to help them make informed decisions to establish a competitive edge in the marketplace.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.