Brazil’s Vale to build Middle East mega hubs to make low-carbon iron products

- September 6, 2023

- Posted by: Quatro Strategies

- Categories: Americas, ESG & Renewable Energy, Middle East, Mining & Metals

Brazilian mining giant Vale SA is embarking on an ambitious project to create “mega hubs” in Middle Eastern countries. These hubs, which will specialize in producing low-carbon iron ore products for the steel industry, are set to begin construction next year. Vale had previously revealed plans to establish these facilities in Saudi Arabia, Oman, and the United Arab Emirates.

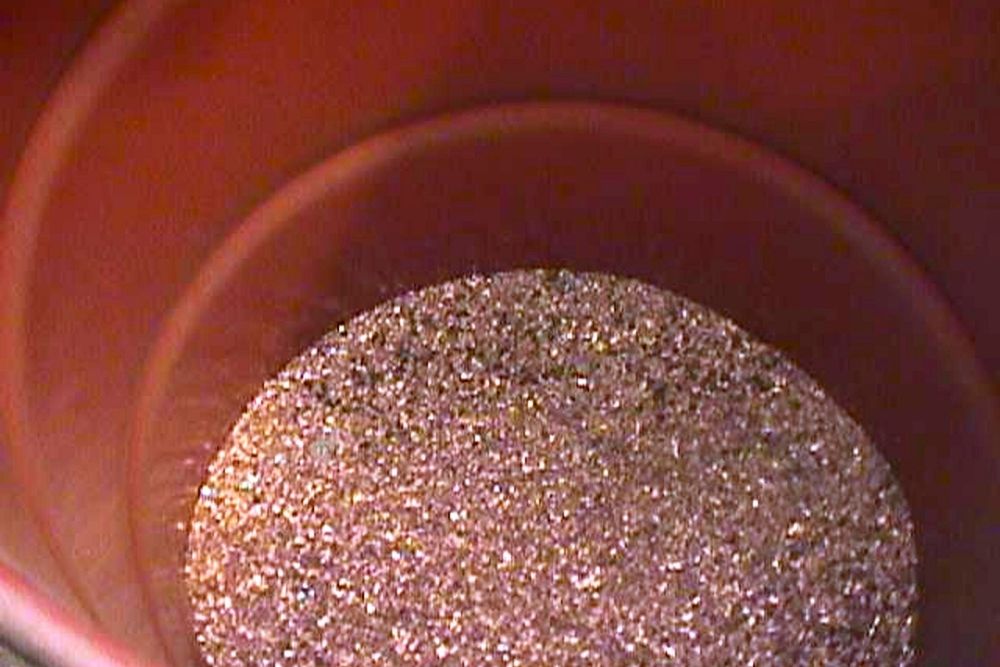

The focal point of these mega hubs will be the production of hot iron ore briquettes, which are designed to serve both local and global markets. The overarching goal of this initiative is to align with global efforts to reduce greenhouse gas emissions from the steel sector. The adoption of iron ore briquettes as an alternative to traditional raw materials represents a significant step toward achieving this environmental objective.

While Vale has not disclosed the exact investment figures for these projects, it’s clear that this endeavor underscores the company’s commitment to sustainable mining practices. As environmental concerns continue to take center stage on the global agenda, Vale is positioning itself to meet the rising demand for eco-friendly materials in the steel production process.

In terms of the project’s logistics, Vale will be responsible for building and operating iron ore concentration and briquetting plants within these mega hubs. Concurrently, local partners will play a pivotal role in developing the essential infrastructure needed to support these operations.

By taking these bold steps, Vale aims not only to strengthen its presence in the Middle East but also to emerge as a leader in sustainable mining and the production of environmentally responsible steelmaking materials. As the steel industry seeks to reduce its carbon footprint, Vale’s forward-looking approach positions it to be a key player in this transformative process.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.