Indonesia nickel prices surge 10% following mining quota investigations

- August 24, 2023

- Posted by: Quatro Strategies

- Categories: Asia Pacific, Mining & Metals, Sanctions & Regulation

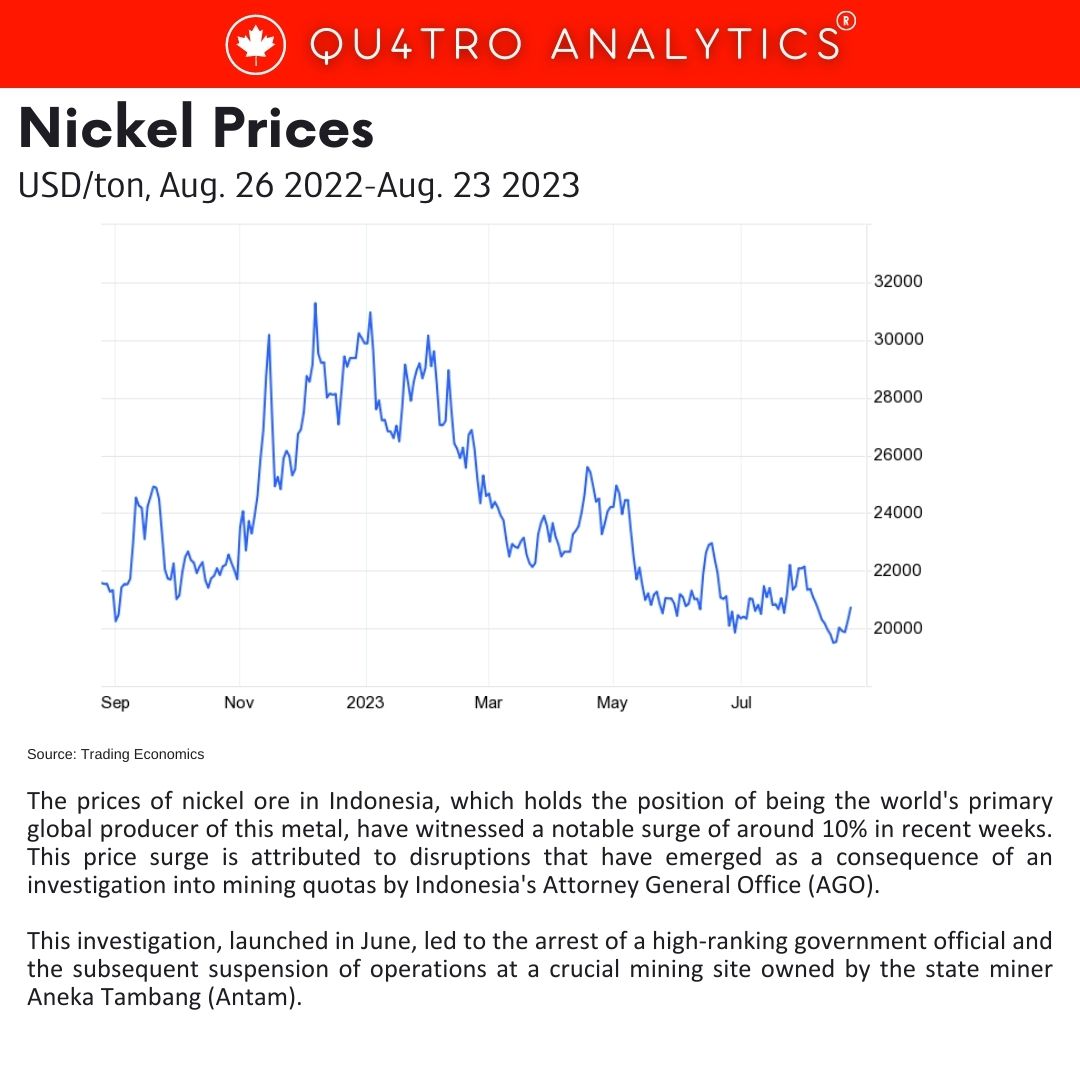

The prices of nickel ore in Indonesia, which holds the position of being the world’s primary global producer of this metal, have witnessed a notable surge of around 10% in recent weeks. This price surge is attributed to disruptions that have emerged as a consequence of an investigation into mining quotas by Indonesia’s Attorney General Office (AGO). This investigation, launched in June, led to the arrest of a high-ranking government official and the subsequent suspension of operations at a crucial mining site owned by the state miner Aneka Tambang (Antam).

In addition to these developments, reports have emerged suggesting that the Indonesian government has suspended the issuance of new mining quotas specifically for nickel miners. This information is substantiated by industry insiders and is in alignment with findings from Chinese consultancy Mysteel. However, the Energy and Mineral Resources Ministry of Indonesia has yet to confirm these claims in response to requests from Reuters.

This disruption within the nickel mining sector has sparked a race among nickel smelters in Indonesia to secure adequate supplies of ore, consequently leading to an upward pressure on nickel ore prices. The concern among these smelters is that supply shortages may be on the horizon, prompting some of them to increase their purchase offers for ore by as much as 15%, according to accounts from industry sources.

Furthermore, the suspension of new mining quotas is expected to have a substantial impact on Indonesia’s ore supply, with forecasts indicating a potential reduction of approximately 30% during the period spanning August to December.

Furthermore, the suspension of new mining quotas is expected to have a substantial impact on Indonesia’s ore supply, with forecasts indicating a potential reduction of approximately 30% during the period spanning August to December.

Despite these disruptions, Antam, the state miner mentioned earlier, has chosen to maintain its 2023 production target at 11.3 million metric tons of wet ore. This decision was conveyed by Syarief Faizal Alkadrie, the corporate secretary of Antam, who spoke to Reuters. It is noteworthy that this production target is sustained even in the face of the operational suspension at the Mandiodo mining block.

Indonesia has historically played a significant role in the global nickel market, accounting for half of the world’s total nickel ore production in 2022, which amounted to 1.61 million metric tons. Much of this nickel ore is processed into nickel pig iron, a vital material used in various industries such as stainless steel and battery production. The impact of the supply disruptions in Indonesia is not confined to its borders; it is also having an influence on the nickel pig iron market in China, the world’s largest consumer of nickel. The prices of nickel pig iron in China have risen by 10% in response to concerns about potential supply shortages emanating from the disruptions in Indonesia.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.