Russia shipping first ever oil cargo to Brazil

- September 14, 2023

- Posted by: Quatro Strategies

- Categories: Americas, Europe, Oil & Gas, Sanctions & Regulation

Russia has shipped its first crude oil cargo to Brazil, marking an attempt to diversify its customer base amid limited options due to U.S. and EU sanctions. European sanctions and price cap policies, imposed in response to Russia’s invasion of Ukraine, have significantly constrained Russia’s oil exports to the West.

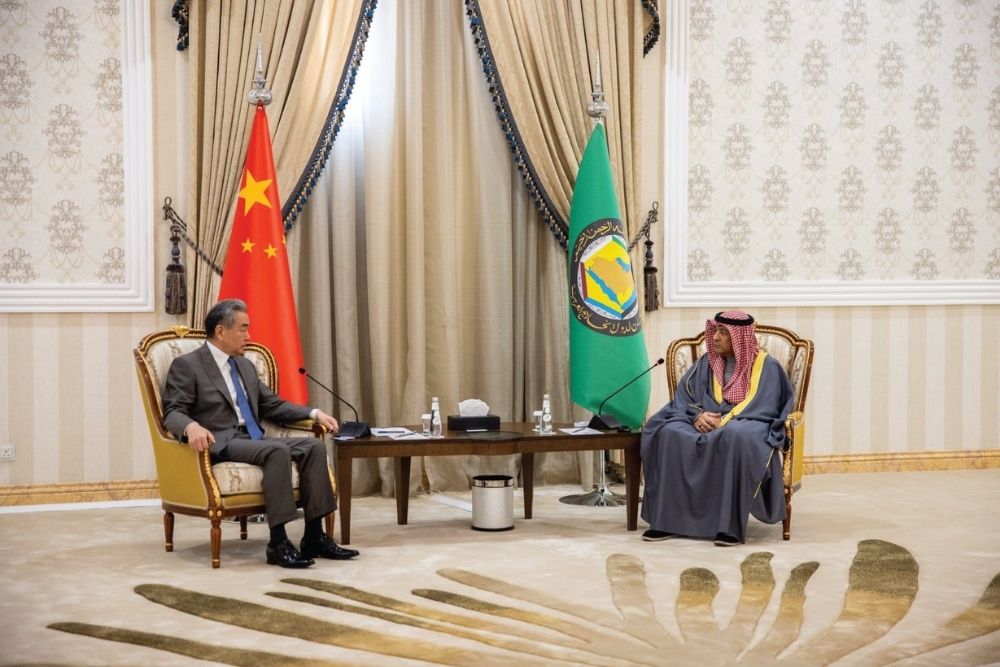

Russia has become increasingly reliant on countries like India and China as key buyers of its crude, often selling oil at discounted prices due to sanctions. Brazil, a member of the BRICs alliance along with India and China, has now emerged as a new destination for Russian crude.

Unlike India and China, which are major importers of Russian oil, Brazil is a significant oil producer and exporter itself. However, Brazil does occasionally import crude to meet its domestic refining needs.

Lukoil, a major Russian oil company, is reportedly shipping 80,000 metric tons of Varandey crude oil to Brazil on the Stratos Aurora vessel from the Murmansk port to the terminal of Madre de Deus port in Brazil, which is operated by Transpetro, a subsidiary of Petrobras.

Varandey Blend is a type of light sweet crude oil, and it differs from the heavier Russian oil grades that have been primarily shipped to India and China in recent months.

The identity of the buyer for this cargo has not been disclosed, and Lukoil, Petrobras, and Brazil’s Ministry of Mines and Energy have yet to comment on the matter. This development underscores Russia’s efforts to expand its oil export markets in response to the sanctions imposed by Western countries.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.