Sweden set to lift ban on uranium mining

- August 23, 2023

- Posted by: Quatro Strategies

- Categories: Europe, Mining & Metals, Sanctions & Regulation

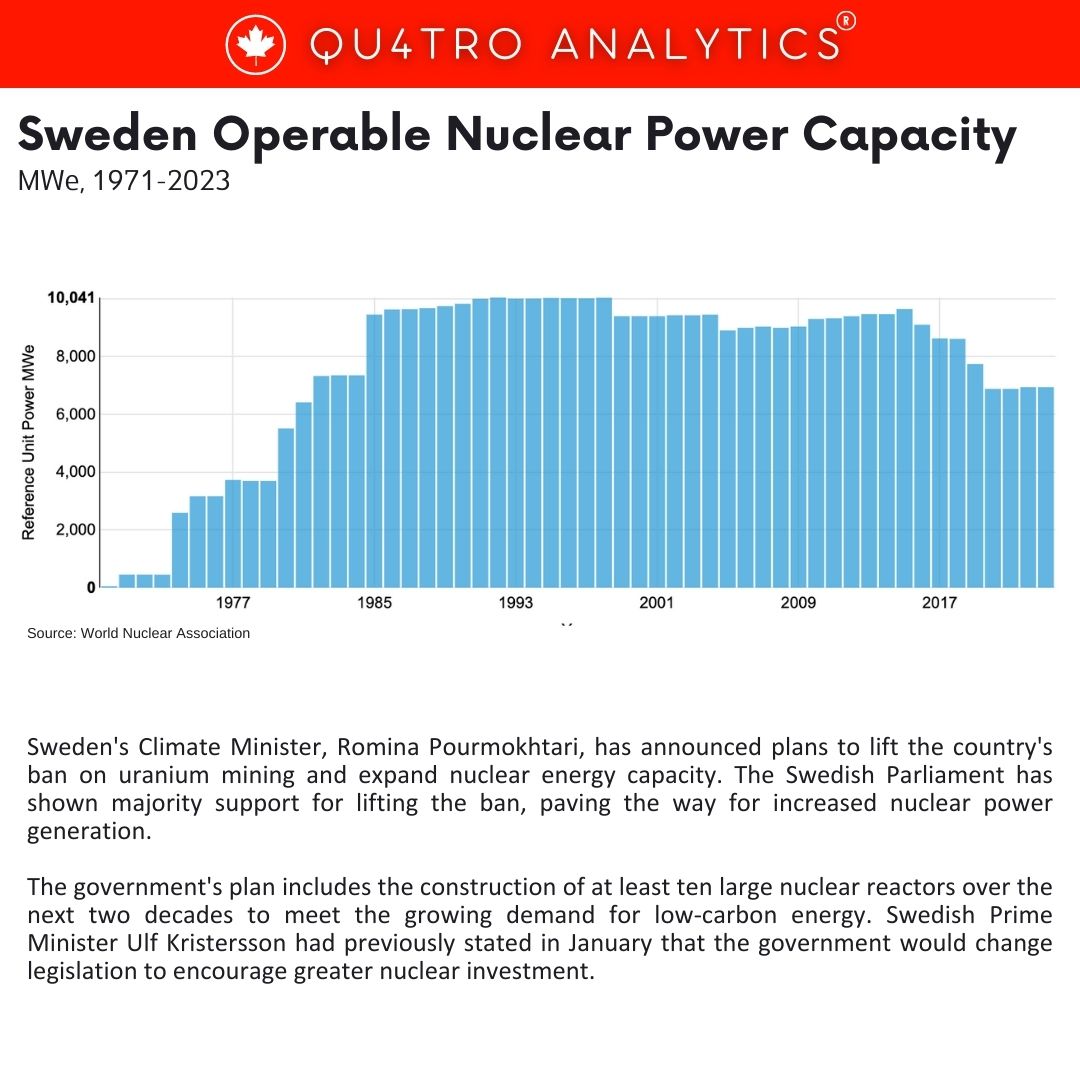

Sweden’s Climate Minister, Romina Pourmokhtari, has announced plans to lift the country’s ban on uranium mining and expand nuclear energy capacity. The Swedish Parliament has shown majority support for lifting the ban, paving the way for increased nuclear power generation.

The government’s plan includes the construction of at least ten large nuclear reactors over the next two decades to meet the growing demand for low-carbon energy. Swedish Prime Minister Ulf Kristersson had previously stated in January that the government would change legislation to encourage greater nuclear investment.

Sweden’s stance on nuclear energy has evolved over the years. The country initially decided to phase out nuclear generation in 1980, adopting an anti-nuclear position. However, this policy was reversed in June 2010. Pourmokhtari is a vocal advocate of nuclear energy and believes it should be a significant part of Sweden’s future energy mix.

Pourmokhtari highlighted the government’s goal to double electricity production over the next 20 years. She emphasized that a substantial portion of this increase must come from dispatchable sources, with nuclear power being the primary non-fossil fuel option. Nuclear energy is touted for its reduced environmental impact and comparatively lower resource requirements.

Pourmokhtari highlighted the government’s goal to double electricity production over the next 20 years. She emphasized that a substantial portion of this increase must come from dispatchable sources, with nuclear power being the primary non-fossil fuel option. Nuclear energy is touted for its reduced environmental impact and comparatively lower resource requirements.

The move to lift the ban on uranium mining is influenced by concerns about Europe’s energy security, given Russia’s dominance in uranium processing. The European Union (EU) has sought to decrease its energy dependence on Moscow, particularly following Russia’s invasion of Ukraine. While Russia is a significant player in uranium processing, Kazakhstan is the largest uranium miner globally, followed by Canada and Namibia.

Sweden holds approximately 80% of the EU’s uranium deposits and already extracts uranium as a byproduct during the mining of other metals. Several companies, including Aura Energy from Australia and Canada’s District Metals, have expressed interest in developing uranium sites in Sweden.

The debate over nuclear generation’s role in achieving net-zero emissions has been a significant point of contention in the European Parliament. Countries like France, which heavily relies on nuclear energy, have supported its expansion, while others like Germany have moved away from nuclear power in favor of renewable energy sources.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.