Nigeria to establish state-backed mineral company to boost investments

- September 4, 2023

- Posted by: Quatro Strategies

- Categories: Africa, Mining & Metals, Rare Earths & Commodities

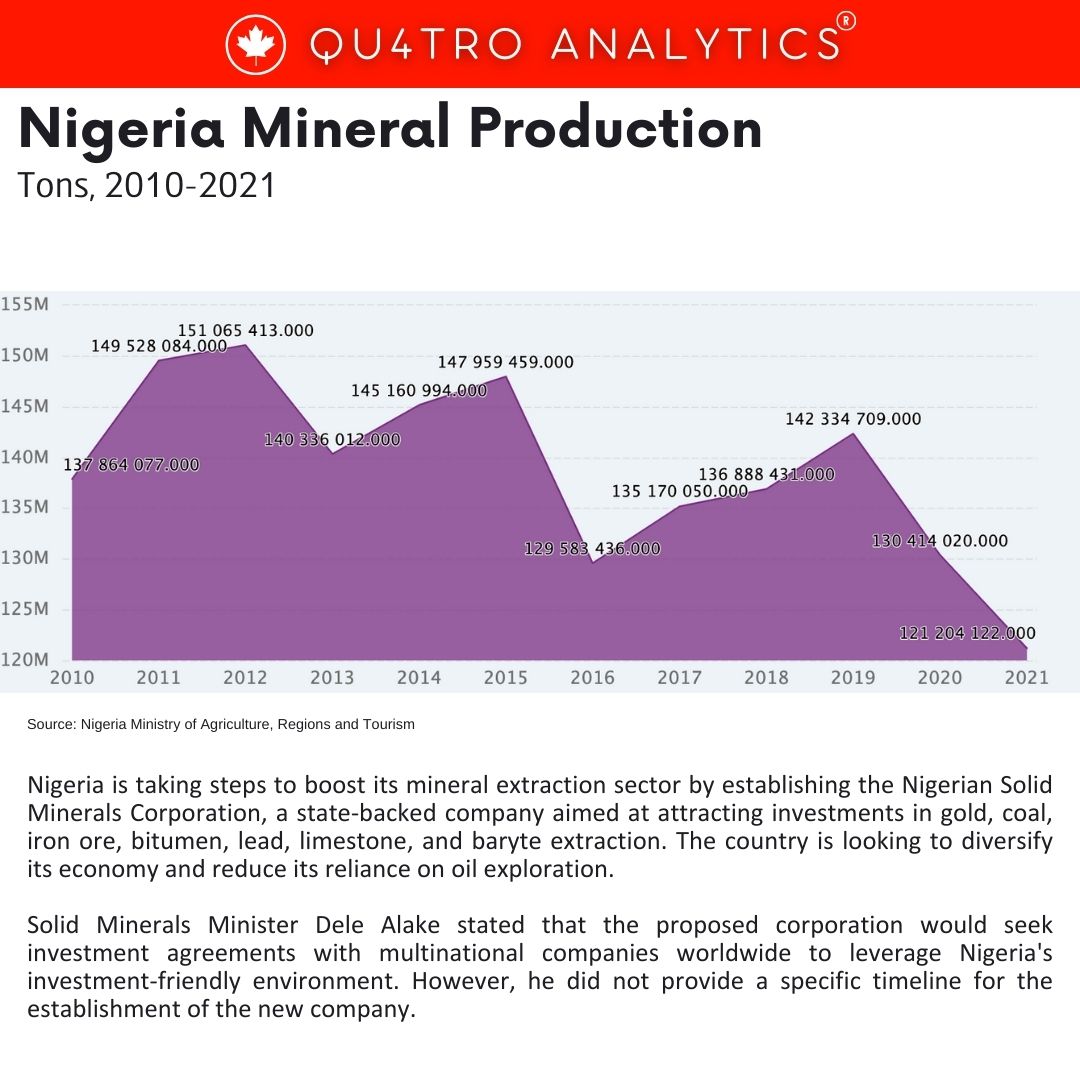

Nigeria is taking steps to boost its mineral extraction sector by establishing the Nigerian Solid Minerals Corporation, a state-backed company aimed at attracting investments in gold, coal, iron ore, bitumen, lead, limestone, and baryte extraction. The country is looking to diversify its economy and reduce its reliance on oil exploration.

Solid Minerals Minister Dele Alake stated that the proposed corporation would seek investment agreements with multinational companies worldwide to leverage Nigeria’s investment-friendly environment. However, he did not provide a specific timeline for the establishment of the new company.

Existing entities like the National Iron Ore Company and the Bitumen Concessioning Programme will be reviewed and incorporated into the new corporation. Additionally, a mines police force will be operational from October to combat illegal mining activities.

Existing entities like the National Iron Ore Company and the Bitumen Concessioning Programme will be reviewed and incorporated into the new corporation. Additionally, a mines police force will be operational from October to combat illegal mining activities.

President Bola Tinubu’s administration is implementing reforms to improve Nigeria’s investment climate and attract foreign investors. These reforms aim to shift the focus from borrowing to investment as a means of creating jobs and stimulating economic growth. Tinubu plans to attend the upcoming G20 summit to promote foreign investment in Nigeria and secure global capital for infrastructure development.

The Nigerian Solid Minerals Corporation will collaborate with local financial institutions, encouraging them to invest in the mining sector, which has historically faced challenges due to lengthy project gestation periods. The move represents part of Nigeria’s broader efforts to diversify its economy and tap into its vast mineral resources.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.