Shell looking to invest in Indian renewable assets

- September 22, 2023

- Posted by: Quatro Strategies

- Categories: ESG & Renewable Energy, India

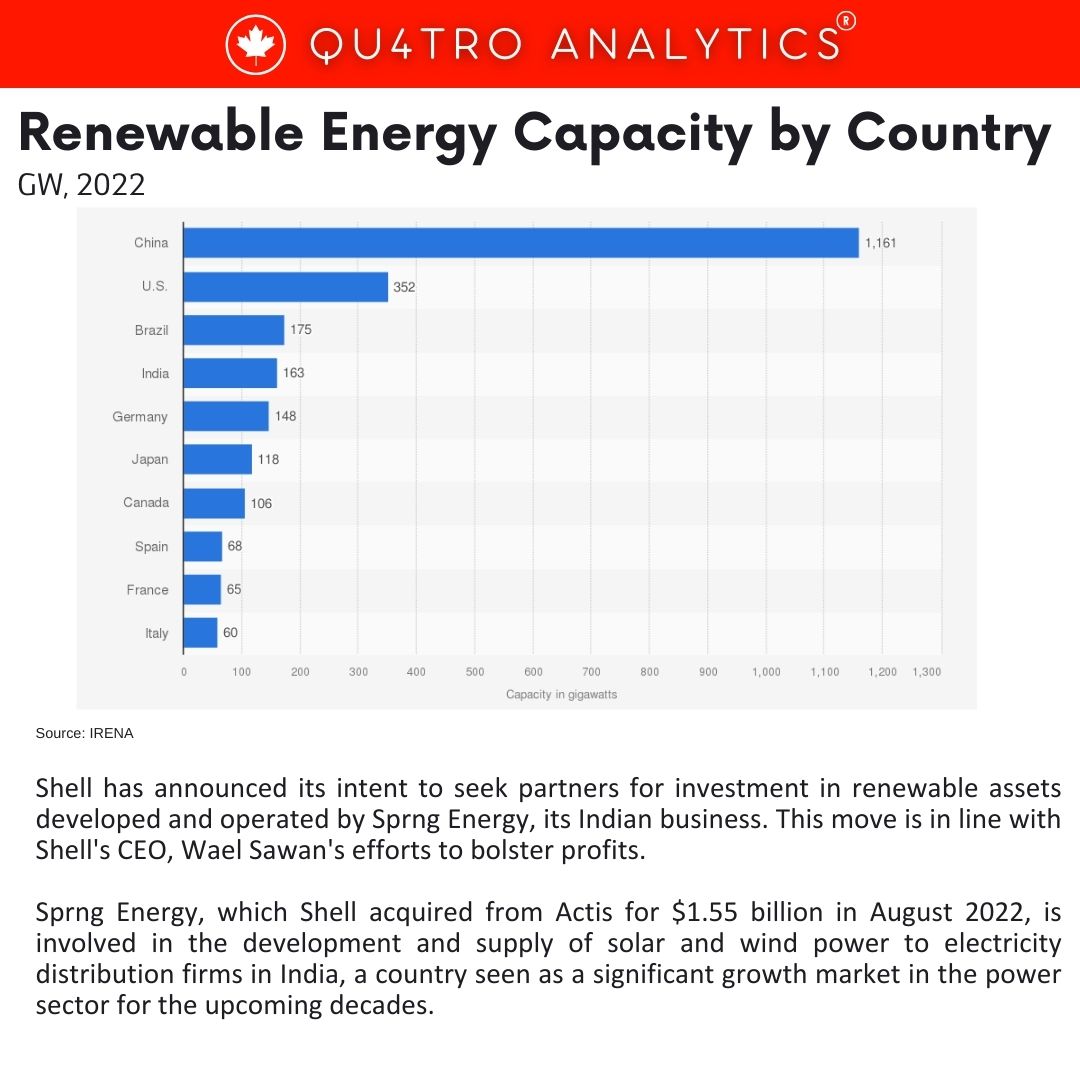

Shell has announced its intent to seek partners for investment in renewable assets developed and operated by Sprng Energy, its Indian business. This move is in line with Shell’s CEO, Wael Sawan’s efforts to bolster profits. Sprng Energy, which Shell acquired from Actis for $1.55 billion in August 2022, is involved in the development and supply of solar and wind power to electricity distribution firms in India, a country seen as a significant growth market in the power sector for the upcoming decades.

Shell expressed its ongoing commitment to developing new projects within the Sprng Energy group while actively exploring partnership opportunities with investors eager to invest in de-risked operational assets. The objective is to have Shell retain a stake in these assets. By focusing on capital discipline, Shell aims to accelerate the growth of its renewables portfolio.

Sawan’s strategy involves enhancing Shell’s performance and returns, which includes a strengthened emphasis on oil and gas operations and a reduction in certain investments in renewables. Recent actions reflecting this strategy include the sale of Shell’s UK power retail business, putting two refineries in Singapore and Germany under strategic review, and exiting several low-carbon projects.

Sawan’s strategy involves enhancing Shell’s performance and returns, which includes a strengthened emphasis on oil and gas operations and a reduction in certain investments in renewables. Recent actions reflecting this strategy include the sale of Shell’s UK power retail business, putting two refineries in Singapore and Germany under strategic review, and exiting several low-carbon projects.

However, this strategy has faced criticism from climate-focused investors, and there has been notable personnel change within Shell’s renewable generation division, with Thomas Brostrom, the head of renewable generation, leaving the company in June.

By QUATRO Strategies International Inc.

QUATRO Strategies International Inc. is the leading business insights and corporate strategy company based in Toronto, Ontario. Through our unique services, we counsel our clients on their key strategic issues, leveraging our deep industry expertise and using analytical rigor to help them make informed decisions to establish a competitive edge in the marketplace.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.