Australia, EU set to resume talks on free trade agreement

- August 31, 2023

- Posted by: Quatro Strategies

- Categories: Asia Pacific, Business & Politics, Europe, Mining & Metals

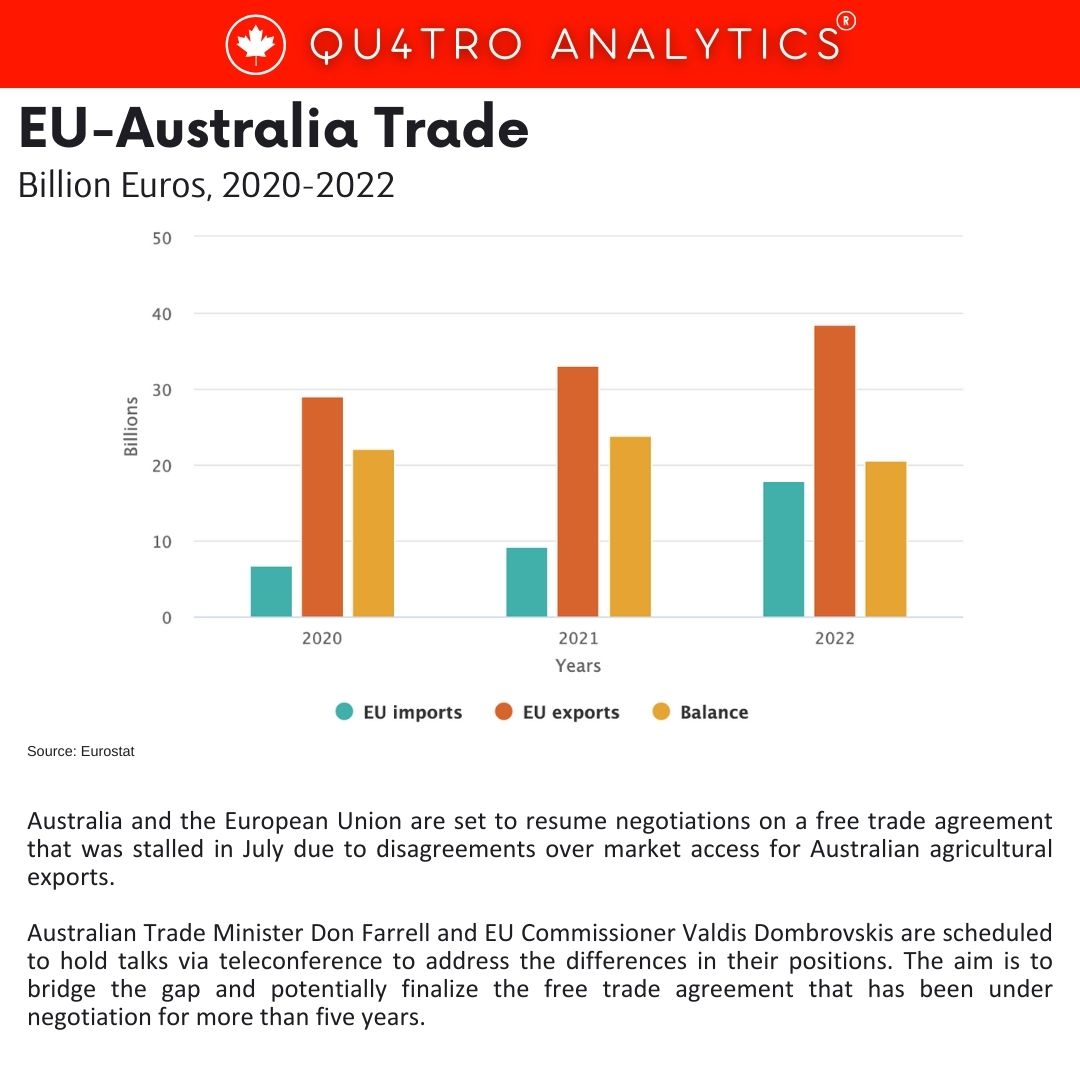

Australia and the European Union are set to resume negotiations on a free trade agreement that was stalled in July due to disagreements over market access for Australian agricultural exports. Australian Trade Minister Don Farrell and EU Commissioner Valdis Dombrovskis are scheduled to hold talks via teleconference to address the differences in their positions. The aim is to bridge the gap and potentially finalize the free trade agreement that has been under negotiation for more than five years.

Trade in goods between the EU and Australia was significant last year, totaling €56.4 billion ($62.1 billion). However, discussions on the free trade agreement have faced challenges, particularly regarding the level of access for Australian agricultural products like beef, dairy, and sugar into the European market. Geographic indicators for certain produce items, such as prosecco and brie, have also been points of contention.

Australia has sought greater concessions from the EU in return for its demands. Meanwhile, EU negotiators have expressed difficulties in agreeing on import quotas for Australian agricultural goods.

Australia has sought greater concessions from the EU in return for its demands. Meanwhile, EU negotiators have expressed difficulties in agreeing on import quotas for Australian agricultural goods.

The resumption of negotiations comes after the previous stalemate dashed hopes of finalizing the agreement earlier in the year. Despite the challenges, both sides have expressed determination to continue the negotiations and find a mutually beneficial resolution.

The EU is particularly interested in this agreement due to its potential for greater access to Australia’s substantial reserves of critical minerals like lithium. These minerals are essential for high-tech manufacturing and the global transition to green energy sources.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.