Australia intends to reignite China trade as some restrictions are rolled back

- August 21, 2023

- Posted by: Quatro Strategies

- Categories: Asia Pacific, Business & Politics, China, Rare Earths & Commodities

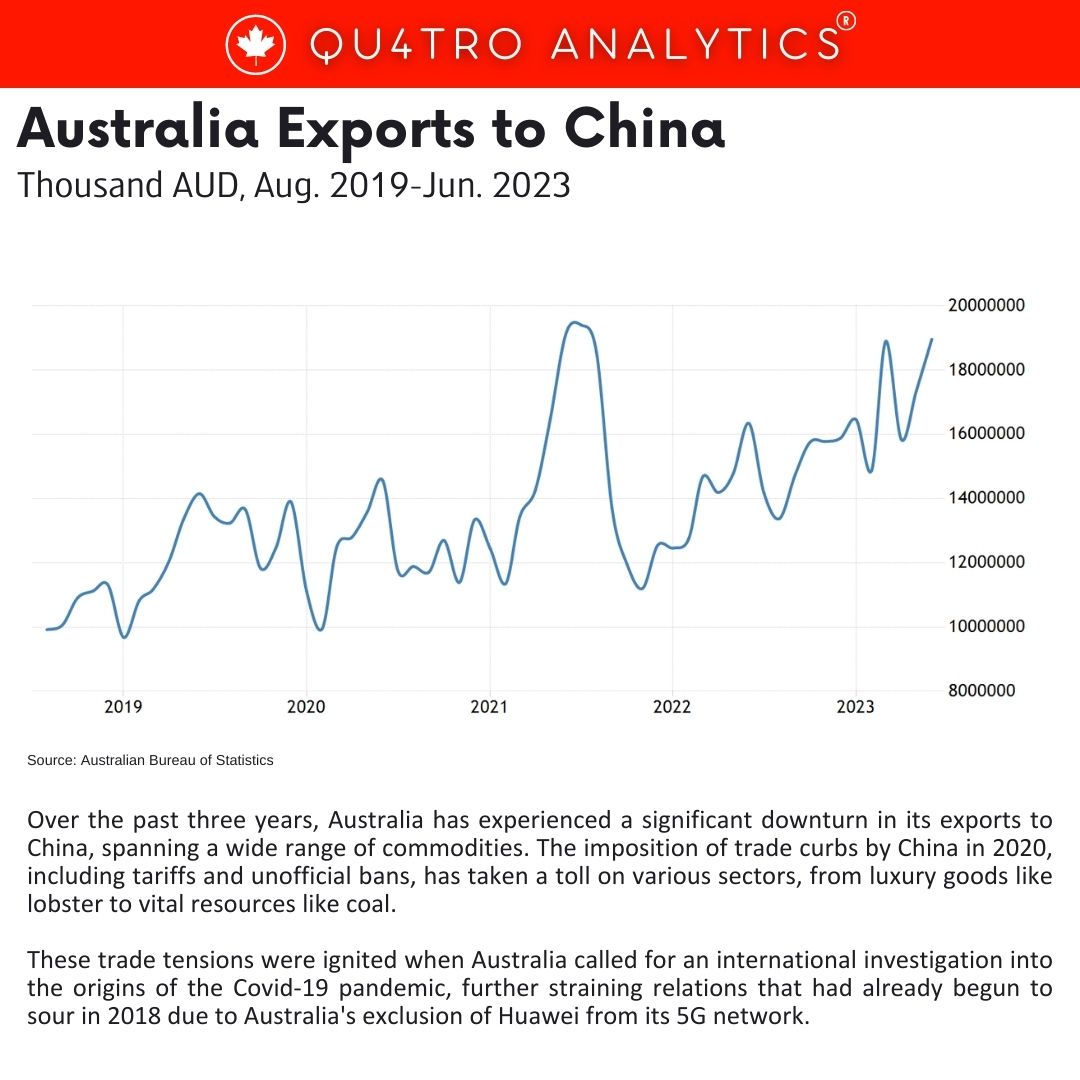

Over the past three years, Australia has experienced a significant downturn in its exports to China, spanning a wide range of commodities. The imposition of trade curbs by China in 2020, including tariffs and unofficial bans, has taken a toll on various sectors, from luxury goods like lobster to vital resources like coal. These trade tensions were ignited when Australia called for an international investigation into the origins of the Covid-19 pandemic, further straining relations that had already begun to sour in 2018 due to Australia’s exclusion of Huawei from its 5G network.

The adverse effects of losing China, its largest trading partner, have reverberated across Australian exporters. However, there seems to be a glimmer of optimism this year as some of the restrictions have been eased. A prime example of this is China’s decision to remove duties on Australian barley, a positive sign of thawing political tensions.

Another significant breakthrough came earlier in the year when China revoked its ban on Australian coal. Although certain controls on commodities like cotton and timber have also relaxed recently, constraints persist for exports such as wine, lobster, and beef.

While the approximately $31 billion in export revenue affected by these restrictions over a three-year period may not account for a substantial portion of Australia’s total goods exports, which exceeded $400 billion last year, certain industries have felt the impact acutely.

Despite the recent positive developments, there remains a prevailing sentiment that some commodities, particularly wine, could substantially benefit from the lifting of duties. However, the prevailing sentiment is that the Chinese market is irreplaceable for these products, and the return to pre-restriction levels of trade might not be fully realized.

Despite the recent positive developments, there remains a prevailing sentiment that some commodities, particularly wine, could substantially benefit from the lifting of duties. However, the prevailing sentiment is that the Chinese market is irreplaceable for these products, and the return to pre-restriction levels of trade might not be fully realized.

Australian Prime Minister Anthony Albanese has expressed his intention to address the remaining trade barriers, specifically those concerning wine, lobster, and select beef products, during his discussions with Chinese President Xi Jinping. Nevertheless, it’s widely acknowledged that while progress might be made in easing certain restrictions, a complete return to the previous trade dynamics is unlikely.

The relationship between Australia and China remains intricate, given that China is Australia’s largest commodities buyer. While China has effectively used trade both as a diplomatic lever and a political tool, Australia’s major export earners, such as iron ore and natural gas, have been relatively unaffected, most likely due to their crucial role in China’s own economic landscape.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.