Beijing’s political decisions hurting China’s economic potential

- September 20, 2023

- Posted by: Quatro Strategies

- Categories: Business & Politics, China, Sanctions & Regulation

The situation in China has sparked what many experts call the “China conundrum” — a perplexing scenario where a nation aspiring to be the world’s dominant economic power is seemingly taking actions that undermine that potential. China’s recent economic moves, such as the crackdown on prominent entrepreneurs, new laws inhibiting business operations, and a shift of capital from the private sector to state-owned enterprises, appear counterintuitive for a country seeking continual economic growth.

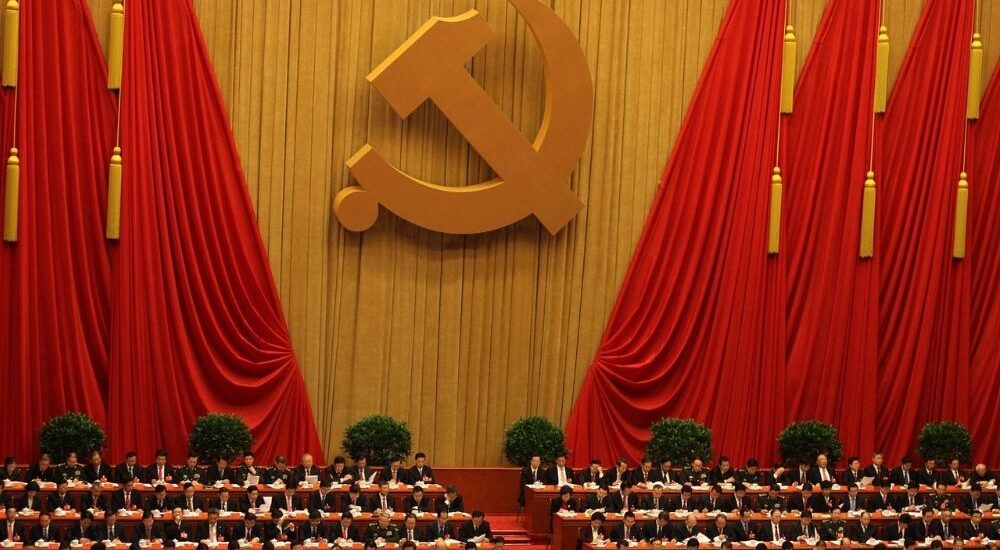

Experts are debating whether these actions are attributed to China’s leader, Xi Jinping, who assumed power in 2012, or if they reflect the inherent nature of the Chinese Communist Party (CCP) that has governed China since 1949. While some pinpoint Xi as the instigator of these changes, others emphasize the broader influence of the CCP. These transformations mark a significant shift from the reforms initiated in 1979, which considerably expanded the role of the private sector and propelled massive economic growth, lifting millions out of poverty.

China’s private sector, historically a growth engine, is now facing the consequences of ideological rigidity and increased control. Xi Jinping’s ideological adherence and desire for control are seen as contradictory to the pragmatism that characterized China’s earlier reform and opening-up period. This shift in governance is likely to reduce economic growth and amplify the role of state-owned enterprises and industrial policy, aligning with Xi’s vision of “common prosperity” through redistribution.

One perspective is that Xi Jinping is a reaction to the Party’s concern about the diminishing influence of the private sector, particularly as it gains more economic power. The CCP, historically concerned about maintaining power, could be reining in the private sector to recapture authority. These changes align with China’s long-term plan, where the private economy and entrepreneurs are supposed to be subservient to the Party, symbolizing the unique flow of power and money in China.

Regardless of the driving force behind these changes, many China observers highlight the fall of communism in the former Soviet Union in 1989 as a pivotal event shaping China’s current trajectory. Xi Jinping’s reluctance to follow a similar path, combined with a return to Marxism-Leninism ideology, suggests a departure from the pragmatic reforms that characterized China’s earlier period of opening-up.

Critics argue that China’s private sector is indeed feeling the pressure, despite the government’s claims of fostering a favorable environment for small and medium-sized enterprises (SMEs) and the private sector. The concern is that once China develops its indigenous technologies, foreign companies could be pushed out of the market, signaling a departure from a more open economic policy.

While China’s government counters these pessimistic views, emphasizing positive economic indicators and promoting an open business environment, skepticism prevails. The recent changes under Xi Jinping pose concerns, raising apprehensions about potentially undoing the tremendous progress achieved in China’s prosperity levels, reflecting a shift towards a more controlled and state-centric economic landscape.

By QUATRO Strategies International Inc.

QUATRO Strategies International Inc. is the leading business insights and corporate strategy company based in Toronto, Ontario. Through our unique services, we counsel our clients on their key strategic issues, leveraging our deep industry expertise and using analytical rigor to help them make informed decisions to establish a competitive edge in the marketplace.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.