China looking for way out of slowing economy

- August 25, 2023

- Posted by: Quatro Strategies

- Categories: Business & Politics, China, Sanctions & Regulation

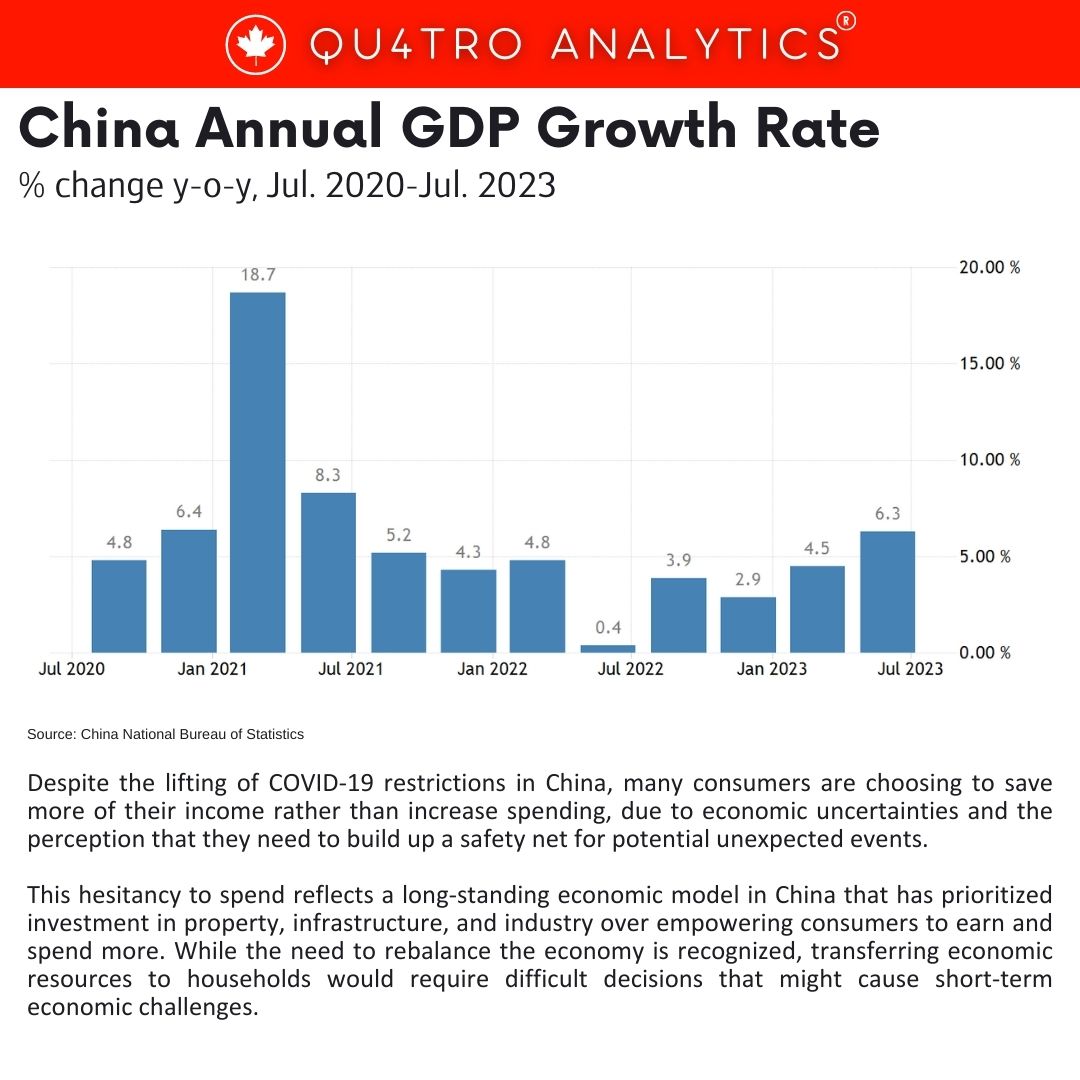

Despite the lifting of COVID-19 restrictions in China, many consumers are choosing to save more of their income rather than increase spending, due to economic uncertainties and the perception that they need to build up a safety net for potential unexpected events. This hesitancy to spend reflects a long-standing economic model in China that has prioritized investment in property, infrastructure, and industry over empowering consumers to earn and spend more. While the need to rebalance the economy is recognized, transferring economic resources to households would require difficult decisions that might cause short-term economic challenges.

Consumer Spending Behavior Amid Economic Uncertainty:

Job Market Uncertainty: China’s job market has faced challenges due to regulatory crackdowns and structural shifts in various industries, particularly the private sector. This has resulted in weak employment prospects, especially for the youth.

Insecurity: Many Chinese consumers, like Erin Yao mentioned in the article, are concerned about financial security. They prioritize saving for potential unexpected expenses or job loss, reflecting a lack of confidence in the stability of the job market.

Economic Model and Consumer Empowerment:

Historical Economic Focus: China’s economic growth model has historically prioritized investment in infrastructure, property, and heavy industries. This model has led to impressive economic growth but also resulted in a lopsided economy with relatively lower consumer spending.

Rebalancing Challenges: Shifting towards a more consumer-driven economy requires reducing the emphasis on investment and industry, which could lead to short-term economic challenges such as business slowdowns and reduced government revenue.

Challenges in Implementing Reforms:

Challenges in Implementing Reforms:

Sectoral Conflicts: Rebalancing the economy involves reallocating resources from sectors like businesses or the government towards households. However, doing so could impact growth and stability in these sectors, potentially leading to economic challenges and job losses.

Local vs. Central Government: Local governments in China control significant assets, and any shift in economic resources could lead to conflicts between local and central authorities. Balancing these interests while achieving economic rebalancing is complex.

Government Measures and Consumer Response:

Government Initiatives: The Chinese government has introduced measures to boost consumer spending, including subsidies, extended operating hours for businesses, and promoting tourism and entertainment activities. These initiatives aim to stimulate spending and support economic recovery.

Mixed Results: These measures have shown mixed results, with some consumers remaining cautious due to ongoing economic uncertainties. Consumer vouchers, for instance, have been issued by some local governments but have not significantly impacted overall consumer spending patterns.

Potential Solutions for Rebalancing:

Social Safety Net Enhancement: Addressing consumers’ concerns about financial security by improving the social safety net could encourage spending. Enhancing unemployment benefits, healthcare coverage, and elderly support could give consumers greater confidence in their financial stability.

Consumer Incentives: Offering incentives such as tax breaks, subsidies, or vouchers specifically targeted at encouraging consumer spending could have a more direct impact on boosting demand.

Labor Market Reforms: Structural reforms that improve the employment situation, particularly for the youth, could increase disposable income and encourage consumer spending.

Complexities in Implementation:

Resource Allocation: Shifting economic resources towards households would require reducing resources allocated to other sectors, which could lead to short-term economic challenges.

Political Considerations: Balancing the interests of various stakeholders, including local governments, businesses, and citizens, while implementing reforms is politically challenging.

China’s current economic model, which prioritized investment and industry over consumer empowerment, is facing the challenge of rebalancing towards greater consumer spending. While measures have been introduced to stimulate consumer demand, challenges such as job market uncertainties and concerns about financial security continue to impact consumer behavior. Achieving a more balanced economy will require careful consideration of sectoral interests, political dynamics, and measures that directly address consumer needs and incentives.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.