China’s Tsingshan starts commercial production at Indonesia nickel refinery

- August 22, 2023

- Posted by: Quatro Strategies

- Categories: Asia Pacific, China, EVs & Battery Technology, Mining & Metals

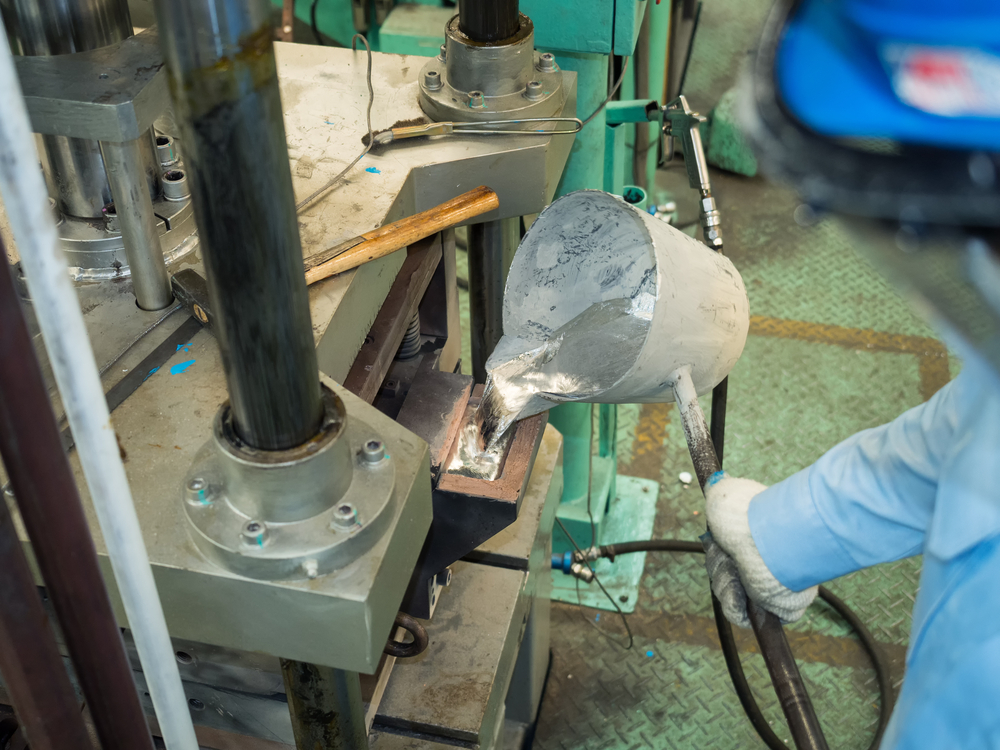

Chinese nickel producer Tsingshan Group has reportedly commenced commercial production of refined nickel at its plant in Morowali, Indonesia. The facility, which boasts a planned annual capacity of 50,000 metric tons, is said to have started commercial production last week, according to sources familiar with the matter. However, the sources chose to remain anonymous as they are not authorized to speak to the media.

Although details regarding the current capacity and the timeline to achieve the full 50,000-ton capacity remain unclear, the sources noted that the plant is currently producing nickel plate.

Notably, Tsingshan Group is reportedly considering seeking approval to list the nickel produced at the Indonesian plant as a deliverable brand on the London Metal Exchange (LME). This process generally entails demonstrating a minimum of three months of stable production.

Such a move would align with the efforts of other Chinese nickel producers, including Zhejiang Huayou Cobalt’s subsidiary and Jingmen Gem Co, which have also applied for their nickel brands to be listed on the LME.

The London Metal Exchange has taken steps to expedite listing procedures for nickel brands after experiencing market turbulence in 2022. In March 2022, LME nickel prices doubled within hours, leading to chaotic trading and prompting the LME to halt its nickel market for the first time since 1988. All nickel trades conducted on that day were canceled. As a response, LME made changes to its listing process to boost nickel trade volumes and restore market stability.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.