Chinese EV makers facing obstacles penetrating EU market

- August 20, 2023

- Posted by: Quatro Strategies

- Categories: China, Europe, EVs & Battery Technology

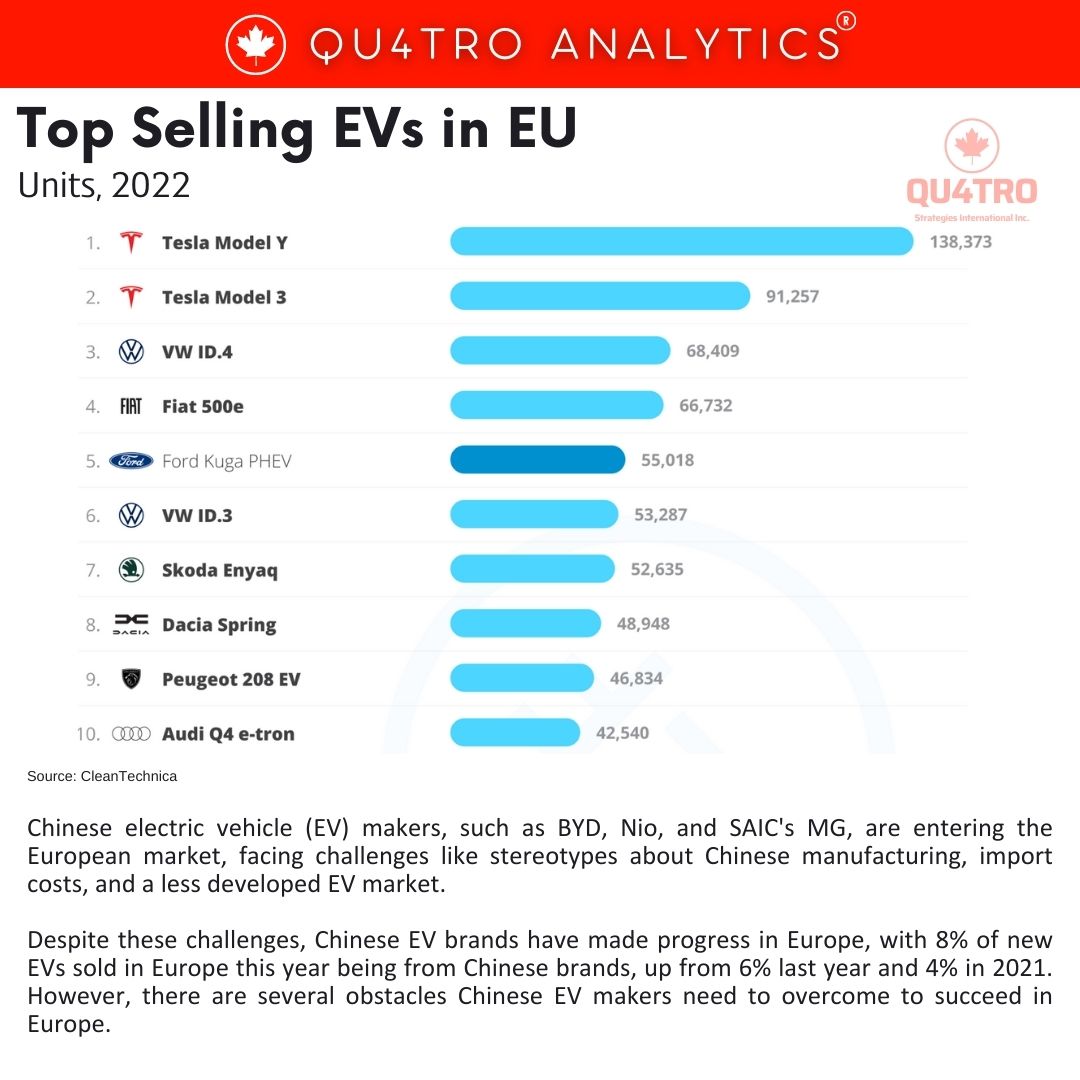

Chinese electric vehicle (EV) makers, such as BYD, Nio, and SAIC’s MG, are entering the European market, facing challenges like stereotypes about Chinese manufacturing, import costs, and a less developed EV market. Despite these challenges, Chinese EV brands have made progress in Europe, with 8% of new EVs sold in Europe this year being from Chinese brands, up from 6% last year and 4% in 2021. However, there are several obstacles Chinese EV makers need to overcome to succeed in Europe.

Chinese EV makers are likely to struggle to sell cars in Europe as cheaply as they do at home due to factors like logistics, sales taxes, import duty, and European certification requirements.

European preferences, such as the demand for larger battery sizes to accommodate longer trips, may add to the production costs of Chinese EVs.

Building trust and brand recognition is a challenge, as surveys indicate that many potential EV buyers in Europe are not aware of Chinese brands, and those who are may have reservations about purchasing a Chinese-made car.

Building trust and brand recognition is a challenge, as surveys indicate that many potential EV buyers in Europe are not aware of Chinese brands, and those who are may have reservations about purchasing a Chinese-made car.

Addressing safety and quality concerns is crucial for Chinese EV makers to win over European consumers. Some have secured five-star safety ratings under European standards, but doubts about quality need to be overcome.

Chinese carmakers need to adapt their marketing strategies to European audiences and overcome any cultural biases that may exist. Some brands have chosen not to emphasize their Chinese heritage due to consumer hesitancy.

Despite these challenges, Chinese EV makers are actively working to gain traction in the European market. Strategies include establishing test drives and showrooms, showcasing higher product quality compared to European counterparts, and embracing competition to change perceptions. It remains to be seen how successfully Chinese EV brands can navigate these challenges and establish a strong presence in the competitive European EV market.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.