Chinese EV makers making presence felt in Europe

- September 4, 2023

- Posted by: Quatro Strategies

- Categories: China, Europe, EVs & Battery Technology

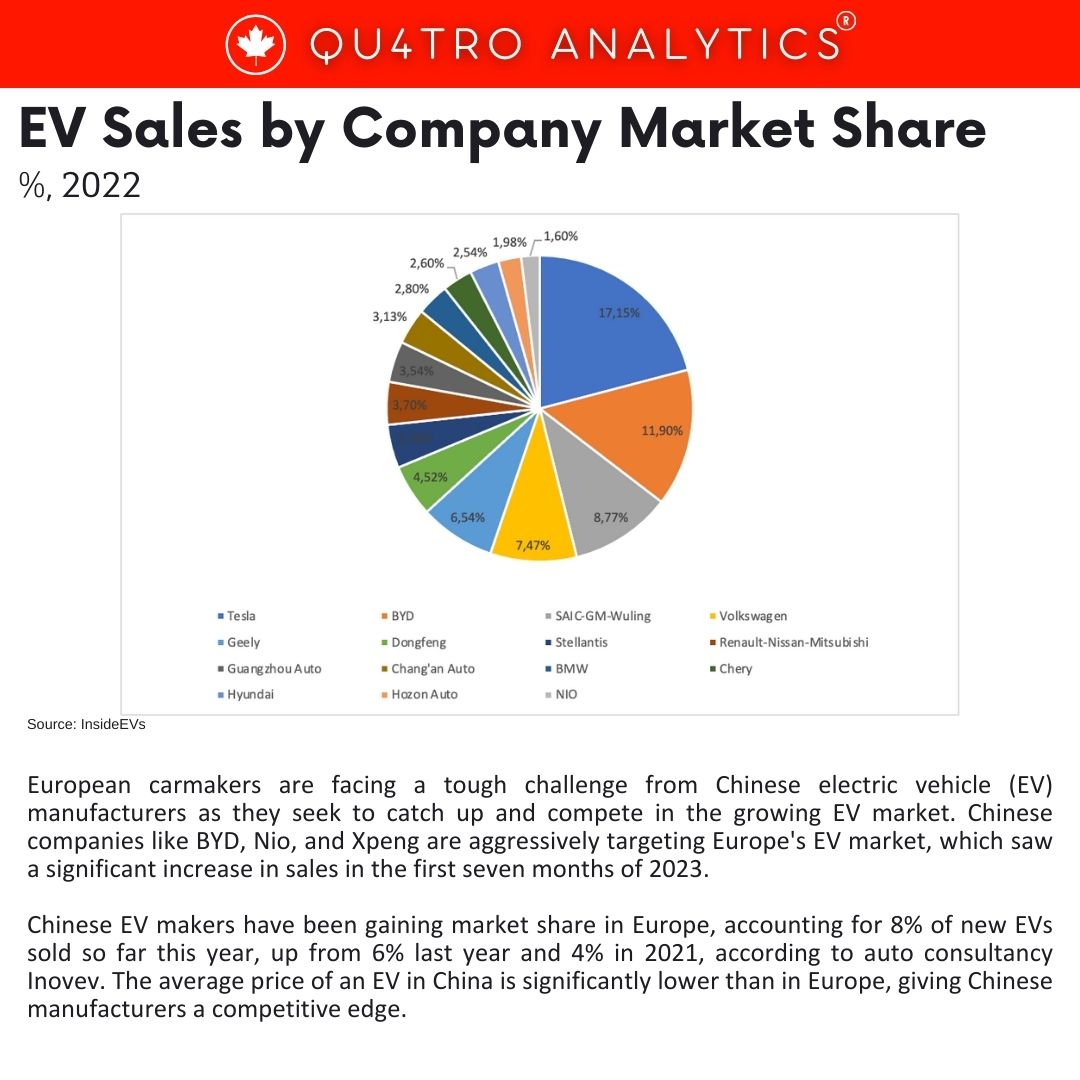

European carmakers are facing a tough challenge from Chinese electric vehicle (EV) manufacturers as they seek to catch up and compete in the growing EV market. Chinese companies like BYD, Nio, and Xpeng are aggressively targeting Europe’s EV market, which saw a significant increase in sales in the first seven months of 2023.

Chinese EV makers have been gaining market share in Europe, accounting for 8% of new EVs sold so far this year, up from 6% last year and 4% in 2021. The average price of an EV in China is significantly lower than in Europe, giving Chinese manufacturers a competitive edge.

At the Munich IAA mobility show, where the presence of Chinese companies has increased, industry analysts and executives expressed concerns that European carmakers need to catch up quickly to remain competitive. Renault CEO Luca de Meo acknowledged that Chinese EV makers are currently ahead of their European counterparts and stressed the need for European manufacturers to close the gap.

Chinese companies such as BYD, Xpeng, and battery maker CATL are expanding their presence in Europe, raising concerns that they could undercut local carmakers and dominate the EV market. Europe’s car industry is also becoming increasingly aware of China’s control over the full battery supply chain.

Chinese companies such as BYD, Xpeng, and battery maker CATL are expanding their presence in Europe, raising concerns that they could undercut local carmakers and dominate the EV market. Europe’s car industry is also becoming increasingly aware of China’s control over the full battery supply chain.

As competition in the EV market intensifies, European carmakers are focusing on price, range, efficiency, and customer satisfaction. Tesla, Mercedes-Benz, BMW, and Volkswagen are all making moves to compete effectively against Chinese rivals. Mercedes-Benz and BMW are targeting higher range and efficiency while halving production costs. Volkswagen is taking a design-oriented approach to differentiate its brands further.

Despite the challenges posed by Chinese EV manufacturers, European carmakers believe that focusing on customer needs and preferences will be essential for their success in the evolving automotive landscape. The industry recognizes the need to adapt and innovate in response to increased competition and changing market dynamics.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.