Chinese solar supplier GCL in talks with Saudi Arabia to open first overseas plant

- September 5, 2023

- Posted by: Quatro Strategies

- Categories: Business & Politics, China, ESG & Renewable Energy, Middle East

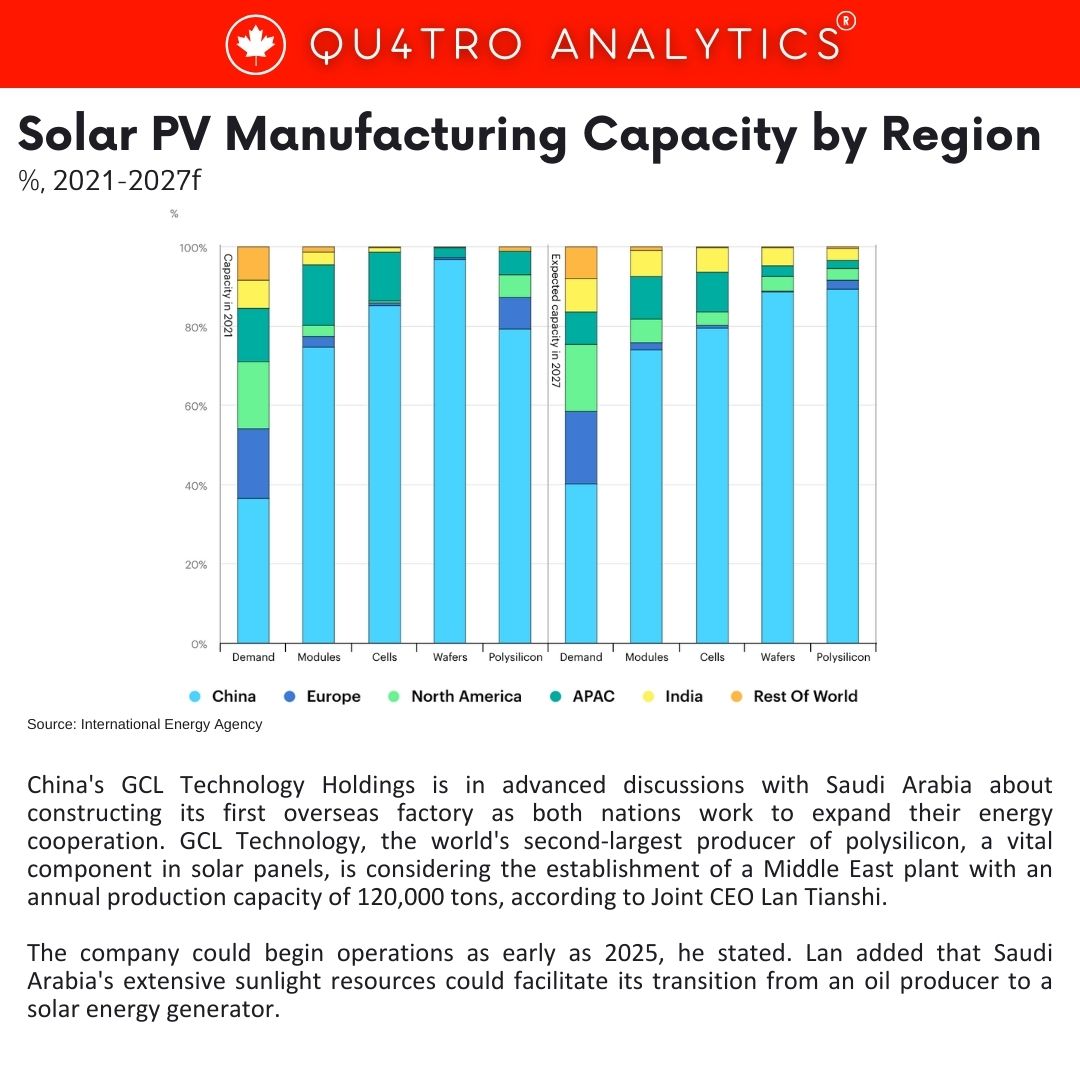

China’s GCL Technology Holdings is in advanced discussions with Saudi Arabia about constructing its first overseas factory as both nations work to expand their energy cooperation. GCL Technology, the world’s second-largest producer of polysilicon, a vital component in solar panels, is considering the establishment of a Middle East plant with an annual production capacity of 120,000 tons, according to Joint CEO Lan Tianshi. The company could begin operations as early as 2025, he stated. Lan added that Saudi Arabia’s extensive sunlight resources could facilitate its transition from an oil producer to a solar energy generator.

Saudi Arabia’s robust infrastructure and industrial manufacturing expertise make it an appealing location for GCL Technology to expand. The company has already filed for registration in the nation, formed a local team of about twelve people, and entered into discussions with local government authorities and the royal commission. While GCL Technology is contemplating establishing outposts in other countries, the Saudi Arabia project is the most advanced at this point.

China and Saudi Arabia have been increasing their energy cooperation, with President Xi Jinping visiting Riyadh in December. Furthermore, at last month’s BRICS forum, China invited Saudi Arabia and other leading oil exporters to join the group. Lan and other GCL Technology executives have made visits to both Saudi Arabia and Qatar. The company is eager to accelerate implementation in both locations. Additionally, the firm has examined the possibility of expanding into Mexico, to serve the North American market, as well as Australia.

China and Saudi Arabia have been increasing their energy cooperation, with President Xi Jinping visiting Riyadh in December. Furthermore, at last month’s BRICS forum, China invited Saudi Arabia and other leading oil exporters to join the group. Lan and other GCL Technology executives have made visits to both Saudi Arabia and Qatar. The company is eager to accelerate implementation in both locations. Additionally, the firm has examined the possibility of expanding into Mexico, to serve the North American market, as well as Australia.

At present, Chinese solar companies are grappling with shrinking profit margins as a result of fierce competition. Lan anticipates a wave of consolidation in the solar supply chain, with only five to ten companies ultimately surviving. Polysilicon prices have plummeted since the beginning of the year, prompting numerous producers to discontinue operations in June. BloombergNEF forecasts a significant oversupply of the material in the second half of the year. Despite the challenges, lower solar prices have boosted demand both in China and abroad, with the country poised to install a record capacity this year, potentially reaching 140 gigawatts, according to the China Photovoltaic Industry Association.

By establishing new infrastructure in Saudi Arabia, GCL Technology would be able to tap into the nation’s large potential market and the higher prices that polysilicon commands overseas. The Middle East offers a more accessible gateway for the material to reach consumers in Africa and Europe.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.