EU wants to make joint gas purchases permanent after high demand

- September 6, 2023

- Posted by: Quatro Strategies

- Categories: Europe, Oil & Gas, Sanctions & Regulation

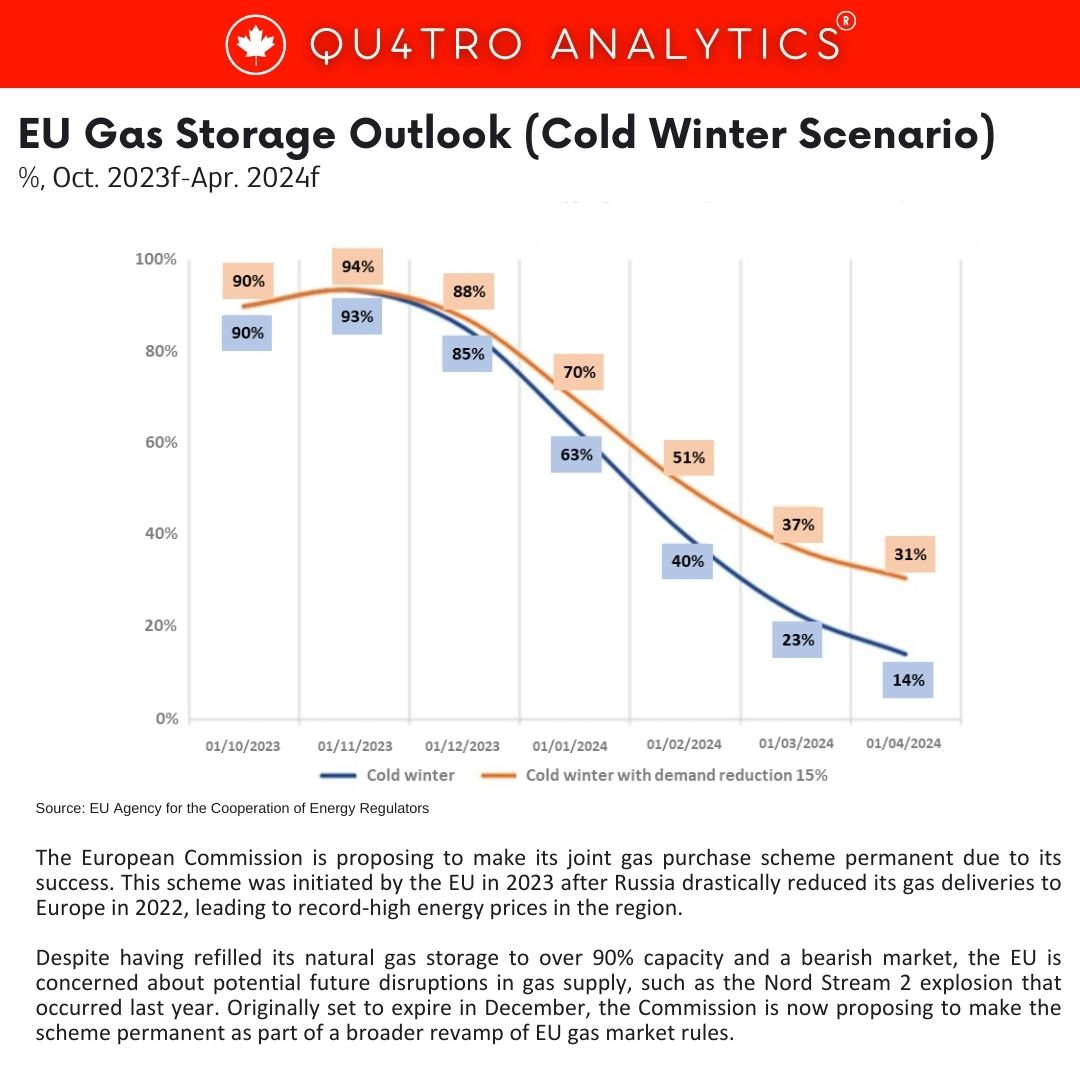

The European Commission is proposing to make its joint gas purchase scheme permanent due to its success. This scheme was initiated by the EU in 2023 after Russia drastically reduced its gas deliveries to Europe in 2022, leading to record-high energy prices in the region. Despite having refilled its natural gas storage to over 90% capacity and a bearish market, the EU is concerned about potential future disruptions in gas supply, such as the Nord Stream 2 explosion that occurred last year. Originally set to expire in December, the Commission is now proposing to make the scheme permanent as part of a broader revamp of EU gas market rules.

Under this proposal, EU companies would have the option to buy gas jointly on a permanent basis. While participation would be voluntary under normal circumstances, if the EU faces a fuel supply crisis, joint purchasing would become mandatory to prevent EU countries from competing for limited volumes of gas.

The scheme has surpassed initial expectations, with more than 27 billion cubic meters of gas demanded, double the 13.5 billion cubic meters initially targeted for joint purchases by the EU. However, it’s unclear how much of this demand has translated into firm contracts, as the EU only matches gas buyers and sellers but is not involved in the commercial negotiations that follow. The new EU proposal would require companies to report when they sign contracts through the scheme.

The scheme has surpassed initial expectations, with more than 27 billion cubic meters of gas demanded, double the 13.5 billion cubic meters initially targeted for joint purchases by the EU. However, it’s unclear how much of this demand has translated into firm contracts, as the EU only matches gas buyers and sellers but is not involved in the commercial negotiations that follow. The new EU proposal would require companies to report when they sign contracts through the scheme.

Negotiations on the proposal will take place between EU member states and the European Parliament, with the aim of finalizing the law by the end of the year. Key discussions will revolve around defining a “supply crisis” that would trigger mandatory joint buying and whether to extend this approach to other energy commodities such as hydrogen. The proposal suggests expanding the scheme to assist the planned European Hydrogen Bank, set to launch in November. Although the joint purchases constitute only a small portion of the EU’s total gas demand, they aim to help countries prepare for winter when gas demand for heating peaks.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.