G20 nations planning to triple renewable capacity, push for scaling up CCS technology

- September 7, 2023

- Posted by: Quatro Strategies

- Categories: Business & Politics, ESG & Renewable Energy, India

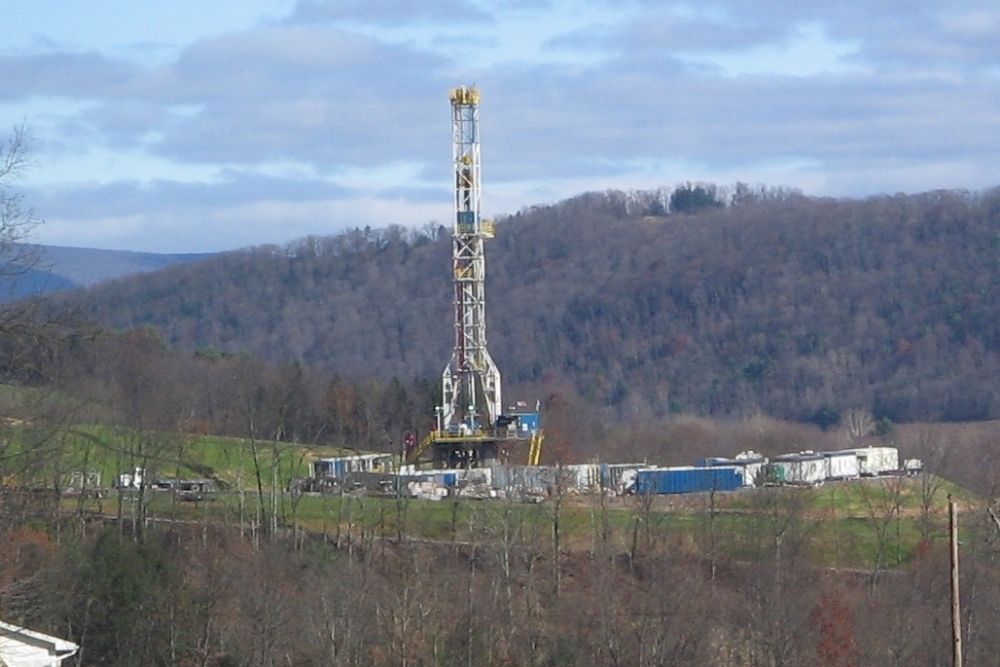

The G20 group of nations is planning to triple renewable capacity by 2030 while also encouraging the use of carbon capture technology to facilitate fossil fuel development. At the G20 summit in India, the group, which includes both major oil and gas producers and energy importers, will reportedly call for greater efforts to deploy technologies that reduce emissions from coal, oil, and natural gas.

This commitment to renewables could boost India’s profile as the host nation of the summit and the UAE’s position, as it is also hosting COP28.

However, the use of carbon capture technology as a way to support fossil fuel development has been met with criticism by some environmental groups. Coal-related emissions in the G20 have risen by 9% per capita since 2015, according to climate change think tank Ember. Despite emissions reductions in recent years, Australia and South Korea emit more than three times the global average in coal-related CO2 emissions. China was third.

Separately, G20 countries spent a record $1.4 trillion since COP26 in 2021 through 2022 on coal, oil, and gas, according to think tank the International Institute for Sustainable Development (IISD). This comes at a time when global efforts are being made to transition to cleaner energy sources and reduce greenhouse gas emissions.

The G20 accounts for 80% of global emissions, and the decision to support carbon capture technology alongside renewable energy expansion underscores the challenges of reaching a consensus on climate action in the group, given the diverse range of interests among its members.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.