Germany imported 75% more vehicles and parts from China in the first half of 2023

- September 18, 2023

- Posted by: Quatro Strategies

- Categories: Business & Politics, China, Europe, EVs & Battery Technology

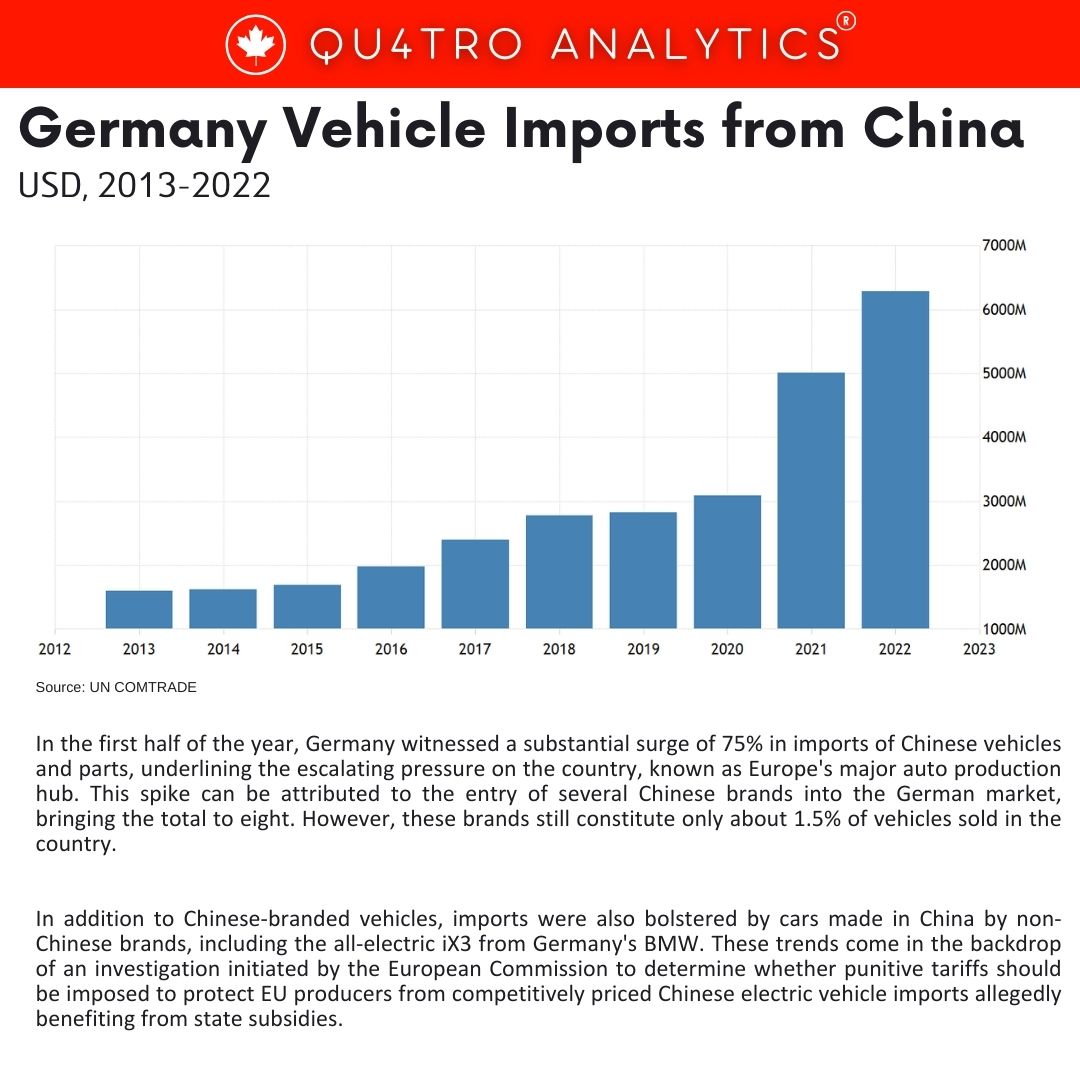

In the first half of the year, Germany witnessed a substantial surge of 75% in imports of Chinese vehicles and parts, underlining the escalating pressure on the country, known as Europe’s major auto production hub. This spike can be attributed to the entry of several Chinese brands into the German market, bringing the total to eight. However, these brands still constitute only about 1.5% of vehicles sold in the country.

In addition to Chinese-branded vehicles, imports were also bolstered by cars made in China by non-Chinese brands, including the all-electric iX3 from Germany’s BMW. These trends come in the backdrop of an investigation initiated by the European Commission to determine whether punitive tariffs should be imposed to protect EU producers from competitively priced Chinese electric vehicle imports allegedly benefiting from state subsidies.

Contrarily, German exports of vehicles and parts to China experienced a 21% slump during the same period, constituting a significant portion of the total decline in exports to China, which stood at over 8%. This presents a growing challenge to Germany’s traditional business model that relies on intercontinental exports of high-quality vehicles, particularly as German automakers are progressively relocating more production to China, even in the premium segment.

The report by the German Economic Institute (IW), titled “Is Derisking Beginning?”, underscores a broader trend where vehicles are increasingly becoming an Asian product. Nearly 60% of all vehicles were produced in an Asian country in the previous year, a significant increase from about 31% in 2000.

The report by the German Economic Institute (IW), titled “Is Derisking Beginning?”, underscores a broader trend where vehicles are increasingly becoming an Asian product. Nearly 60% of all vehicles were produced in an Asian country in the previous year, a significant increase from about 31% in 2000.

This signifies a decline in the significance of Europe, with only Germany and Spain remaining among the top ten auto producers globally, as opposed to 2000 when France, Britain, and Italy were also part of this league.

Germany, at times, has been viewed as a potential weak link in Western efforts to decouple from China due to its strong business ties with the Asian superpower, which became Germany’s single largest trade partner in 2016. However, over the past year, Germany has joined the broader initiative to reduce dependence on China, referred to as “de-risking.”

The IW report indicates a potential shift in Germany’s reliance on China, showing early signs of derisking. Approximately 70% of product groups that traditionally have a high value and where China accounts for over half of the imports witnessed a decline in China’s market share.

The chemicals sector accounted for a significant portion of the total decline in imports. Nonetheless, it is essential to emphasize that it’s premature to draw definitive conclusions from the available data regarding derisking. The IW underlines the necessity for more comprehensive data, particularly related to indispensable products and supply chain dynamics, to better evaluate this ongoing trend.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.