India remains main buyer of Russian Urals crude

- September 6, 2023

- Posted by: Quatro Strategies

- Categories: Europe, India, Oil & Gas, Sanctions & Regulation

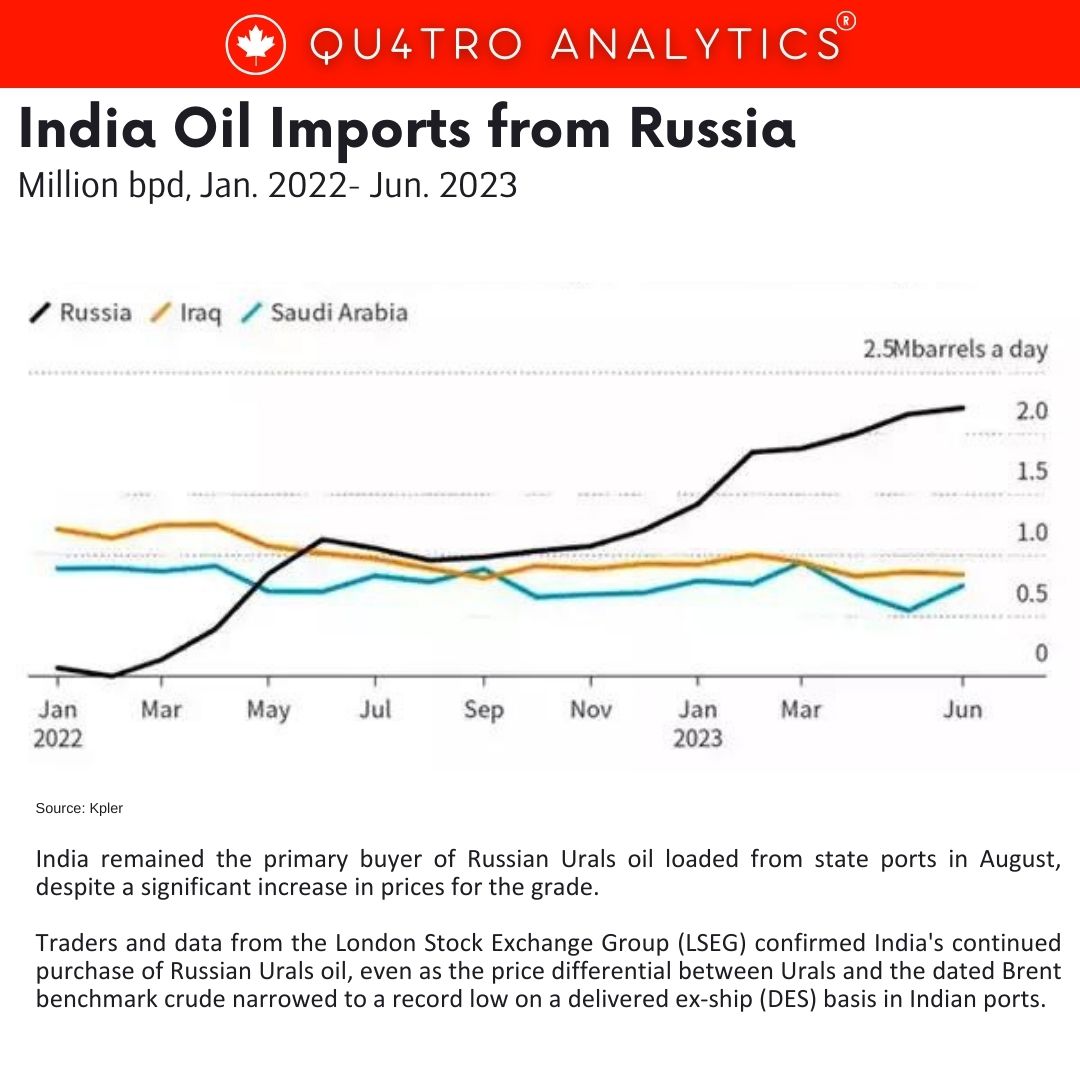

India remained the primary buyer of Russian Urals oil loaded from state ports in August, despite a significant increase in prices for the grade. Traders and data from the London Stock Exchange Group (LSEG) confirmed India’s continued purchase of Russian Urals oil, even as the price differential between Urals and the dated Brent benchmark crude narrowed to a record low on a delivered ex-ship (DES) basis in Indian ports.

The narrowing price gap between Urals and Brent prompted Indian refineries to cut their purchases of Urals oil for September. The discounts for Urals oil loading in August fell to $5 per barrel and below on a DES basis in Indian ports, marking the lowest level since the European Union imposed an embargo on Russian oil.

This price increase for Urals was driven by Russia’s decision to reduce oil exports by 500,000 barrels per day (bpd) in August as part of its cooperation with OPEC+ to stabilize oil markets. Russia has committed to reducing oil exports by 300,000 bpd until the end of the year.

This price increase for Urals was driven by Russia’s decision to reduce oil exports by 500,000 barrels per day (bpd) in August as part of its cooperation with OPEC+ to stabilize oil markets. Russia has committed to reducing oil exports by 300,000 bpd until the end of the year.

Russia’s significant reliance on India as its main oil buyer has raised concerns for Russian oil companies, especially as Russia prepares for increased loadings from Primorsk, Ust-Luga, and Novorossiysk ports in September, coinciding with decreased demand in India due to seasonal maintenance.

In August, Russian Urals oil deliveries to India accounted for about 69% of total shipments from these ports or approximately 74% of shipments of Russian-origin crude oil. This situation is in line with July, indicating India’s continued importance as a destination for Russian Urals oil.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.