India’s crude oil imports from Russia rebound in September

- October 2, 2023

- Posted by: Quatro Strategies

- Categories: Europe, India, Oil & Gas

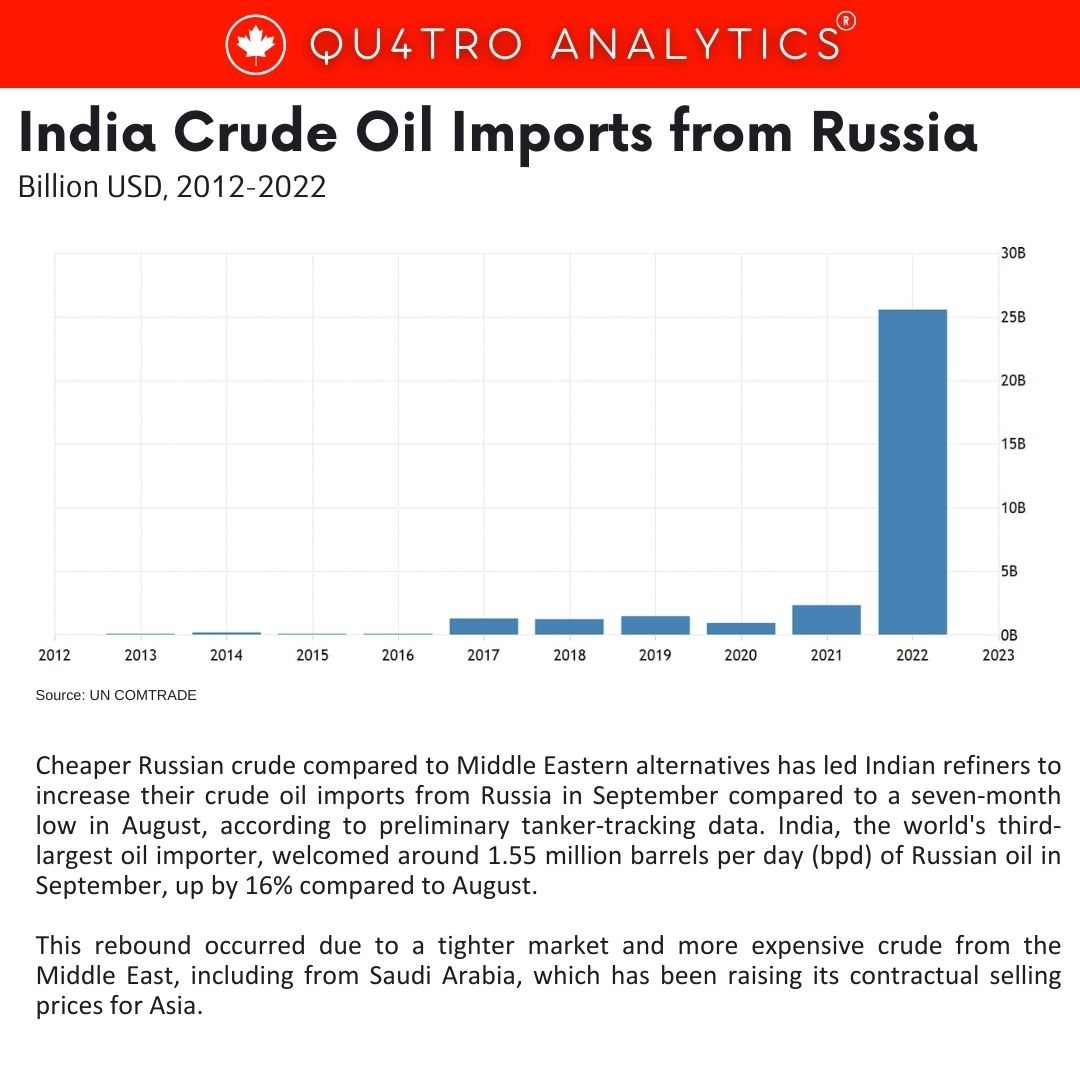

Cheaper Russian crude compared to Middle Eastern alternatives has led Indian refiners to increase their crude oil imports from Russia in September compared to a seven-month low in August, according to preliminary tanker-tracking data. India, the world’s third-largest oil importer, welcomed around 1.55 million barrels per day (bpd) of Russian oil in September, up by 16% compared to August.

This rebound occurred due to a tighter market and more expensive crude from the Middle East, including from Saudi Arabia, which has been raising its contractual selling prices for Asia.

Russian grades are cheaper on the spot market than Middle Eastern crude in term contracts. With recent hikes in Saudi prices, Indian refiners are more inclined to buy Iraq’s Basrah Medium, which is approximately $2 a barrel cheaper than Saudi Arabia’s Arab Light and Arab Medium.

Russian grades are cheaper on the spot market than Middle Eastern crude in term contracts. With recent hikes in Saudi prices, Indian refiners are more inclined to buy Iraq’s Basrah Medium, which is approximately $2 a barrel cheaper than Saudi Arabia’s Arab Light and Arab Medium.

Despite the recent increase, Russian crude is still cheaper by over $10 per barrel compared to grades from the Middle East.

In recent days, tightening global crude supply and rising international prices have raised the price at which Russia’s crude is being sold to India to about $20 per barrel over the G7 price cap of $60.

The Russian flagship crude grade, Urals, is being sold to one of Moscow’s top two customers, India, at nearly $80 per barrel. This price, although higher, is still comparatively lower than Middle Eastern grades.

QUATRO Strategies International Inc. is the leading business insights and corporate strategy company based in Toronto, Ontario. Through our unique services, we counsel our clients on their key strategic issues, leveraging our deep industry expertise and using analytical rigor to help them make informed decisions to establish a competitive edge in the marketplace.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.