Kenya unveils hydrogen strategy backed by EU’s global gateway initiative

- September 6, 2023

- Posted by: Quatro Strategies

- Categories: Africa, Business & Politics, ESG & Renewable Energy, Europe

Kenya has announced a green hydrogen roadmap aimed at enhancing food security and reducing its dependence on imported fertilizers. The plan, unveiled by the Kenyan energy ministry, outlines targets and actions to be taken until 2032. In the initial phase, Kenya intends to have the first commercial-scale green hydrogen projects operational by 2027, accompanied by 100 MW of installed electrolyser capacity. This capacity could enable the production of 100,000 tons of nitrogen fertilizers annually, replacing approximately 20% of Kenya’s current fertilizer imports.

The ministry also intends to replace all methanol imports, about 5,000 tons per year, with domestically produced green alternatives by 2027. Renewable hydrogen can be used to produce synthetic methanol, known as e-methanol. The second phase of the roadmap, spanning from 2028 to 2032, targets between 150 MW and 250 MW of installed electrolyser capacity, with the aim of increasing domestic fertilizer production to as much as 400,000 tons per year. Throughout this period, the country will explore opportunities for exporting green fertilizers within the region.

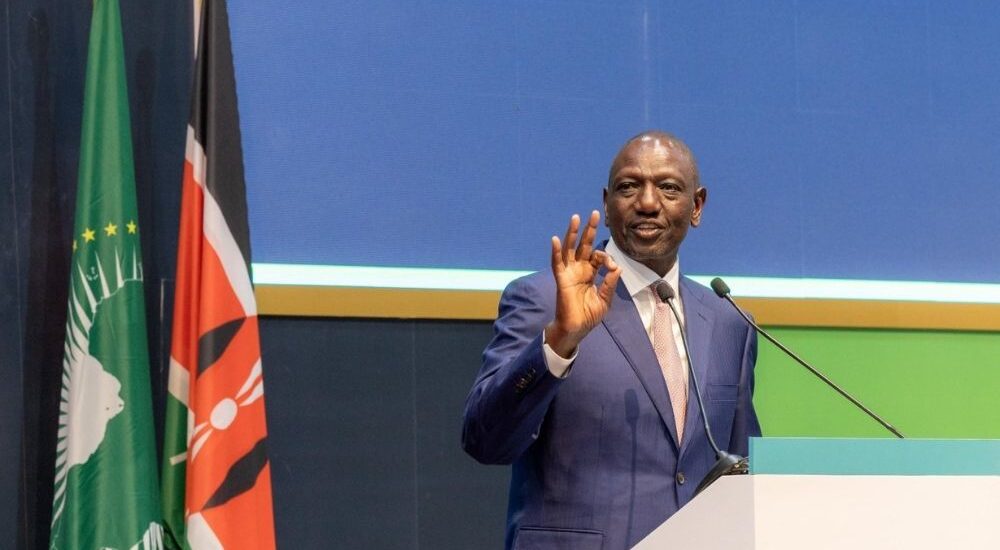

Kenya’s President, William Ruto, emphasized that a green hydrogen economy would help decarbonize the nation’s industrial activities and enhance food security, including the expansion of green production for various agricultural products such as tea, coffee, horticulture, floriculture, and grains.

During the second phase of the roadmap, production of green shipping fuels is planned to commence, alongside pilot projects that utilize hydrogen in other sectors such as power and transport. To support this ambitious plan, the Kenyan government is actively seeking international financial support, with backing from the European Union’s Global Gateway international investment scheme, which will provide nearly €12 million in grants. Germany is also offering a €60 million loan to support green fertilizer production, and the European Investment Bank is collaborating with Kenya on its green hydrogen initiatives.

However, to meet the production targets, the ministry acknowledges that more engagement from international financial institutions will be necessary. The government anticipates over $1 billion in direct investment in green hydrogen by 2032 and emphasizes that blended financing and innovative financial instruments will be crucial to enable growth in the industry.

Kenya is making strides in renewable energy and sustainability, with a goal to have 100% of its electricity supplied from renewable sources by 2030, leveraging its abundant geothermal generation capacity and now aiming to expand its role in the green hydrogen sector.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.