Russia agreed with OPEC+ partners to cut oil exports

- September 1, 2023

- Posted by: Quatro Strategies

- Categories: Europe, Middle East, Oil & Gas, Sanctions & Regulation

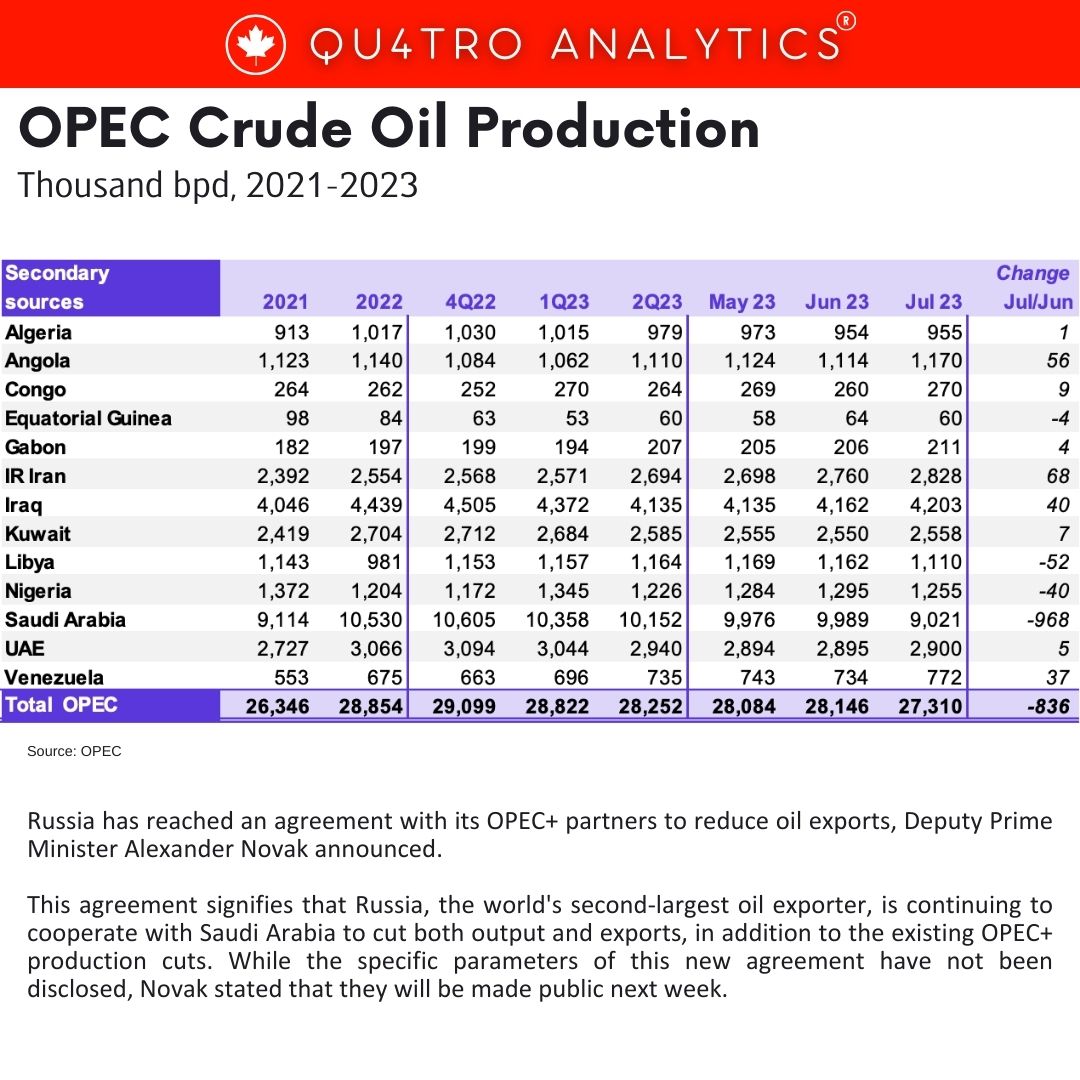

Russia has reached an agreement with its OPEC+ partners to reduce oil exports, Deputy Prime Minister Alexander Novak announced. This agreement signifies that Russia, the world’s second-largest oil exporter, is continuing to cooperate with Saudi Arabia to cut both output and exports, in addition to the existing OPEC+ production cuts. While the specific parameters of this new agreement have not been disclosed, Novak stated that they will be made public next week.

Russia’s decision to further cut oil exports suggests that both Russia and Saudi Arabia are considering extending their voluntary production cuts into October. This move comes amid persistently high oil prices, with Brent crude currently trading at approximately $86.70 per barrel. The reduction in oil exports is part of Russia’s ongoing efforts to support global oil prices and maintain stability in the oil market.

The Organization of the Petroleum Exporting Countries (OPEC) and its allies, including Russia, initially began implementing production cuts in late 2022 to help bolster oil prices. These supply curbs were extended into 2024 in June of this year. Additionally, Russia had previously announced plans to reduce oil exports by 500,000 barrels per day (bpd) in August and by 300,000 bpd in September.

The Organization of the Petroleum Exporting Countries (OPEC) and its allies, including Russia, initially began implementing production cuts in late 2022 to help bolster oil prices. These supply curbs were extended into 2024 in June of this year. Additionally, Russia had previously announced plans to reduce oil exports by 500,000 barrels per day (bpd) in August and by 300,000 bpd in September.

While it is not yet confirmed whether the cuts will be extended into October, analysts anticipate that both Russia and Saudi Arabia may continue their voluntary production cuts to keep oil prices at desired levels. This decision will likely be influenced by the ongoing dynamics of the global oil market and geopolitical factors affecting oil supply and demand.

Oil prices have experienced notable fluctuations in recent months, with Brent crude prices seeing a significant increase of 14% in July alone, marking the largest monthly gain since January 2022. The decision to further reduce oil exports demonstrates the commitment of major oil-producing nations to supporting the oil market and stabilizing prices amidst ongoing uncertainties in the global energy landscape.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.