Saudi Arabia to extend 1 million barrel oil cut into October

- August 24, 2023

- Posted by: Quatro Strategies

- Categories: Business & Politics, Middle East, Oil & Gas

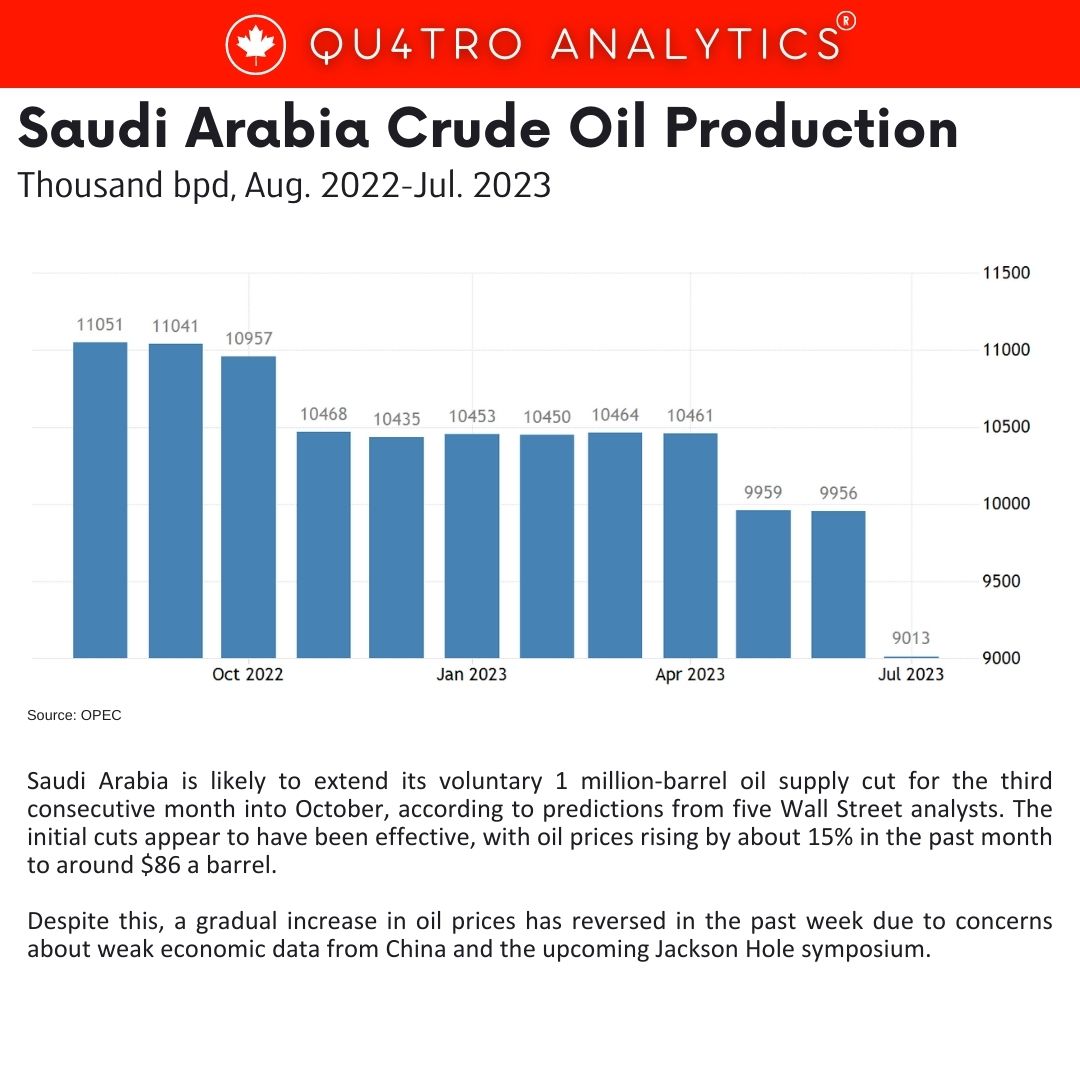

Saudi Arabia is likely to extend its voluntary 1 million-barrel oil supply cut for the third consecutive month into October, according to predictions from five Wall Street analysts. The initial cuts appear to have been effective, with oil prices rising by about 15% in the past month to around $86 a barrel. Despite this, a gradual increase in oil prices has reversed in the past week due to concerns about weak economic data from China and the upcoming Jackson Hole symposium.

The current Brent crude prices of $82.71 are considered too low for Saudi Arabia, as the country needs oil prices at around $100 a barrel to balance its fiscal budget. This provides the country with further incentive to maintain tight supplies in the market. Richard Bronze, an analyst at consultancy Energy Aspects, has stated that Saudi Arabia is likely to extend the supply cut through October. The cautious approach is influenced by the weaker oil market conditions in the first half of the year, and the country will want to see a significant decline in global inventories before considering unwinding the additional cuts.

Analysts from brokerage PVM Oil and Saxo Bank have also speculated that a potential resumption of oil production from Iraq’s Kurdistan region might lead Saudi Arabia to withhold additional supplies to the market for the time being. Despite these uncertainties, oil markets are expected to tighten gradually, leading to an increase in prices as the months progress.

Analysts from brokerage PVM Oil and Saxo Bank have also speculated that a potential resumption of oil production from Iraq’s Kurdistan region might lead Saudi Arabia to withhold additional supplies to the market for the time being. Despite these uncertainties, oil markets are expected to tighten gradually, leading to an increase in prices as the months progress.

The International Energy Agency (IEA) has predicted a global oil shortage of approximately 1.7 million barrels per day during the second half of the year. Experts at Standard Chartered have forecasted a supply deficit of 2.81 million barrels per day in August, 2.43 million barrels per day in September, and over 2 million barrels per day in November and December. Their projections also suggest that global inventories will decrease by 310 million barrels by the end of 2023 and another 94 million barrels in the first quarter of 2024, contributing to higher oil prices. The experts anticipate that Brent prices will rise to $93 per barrel in the fourth quarter.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.