U.S. firm Apache to invest $1.4 billion in Egypt’s energy sector

- August 22, 2023

- Posted by: Quatro Strategies

- Categories: Africa, Oil & Gas

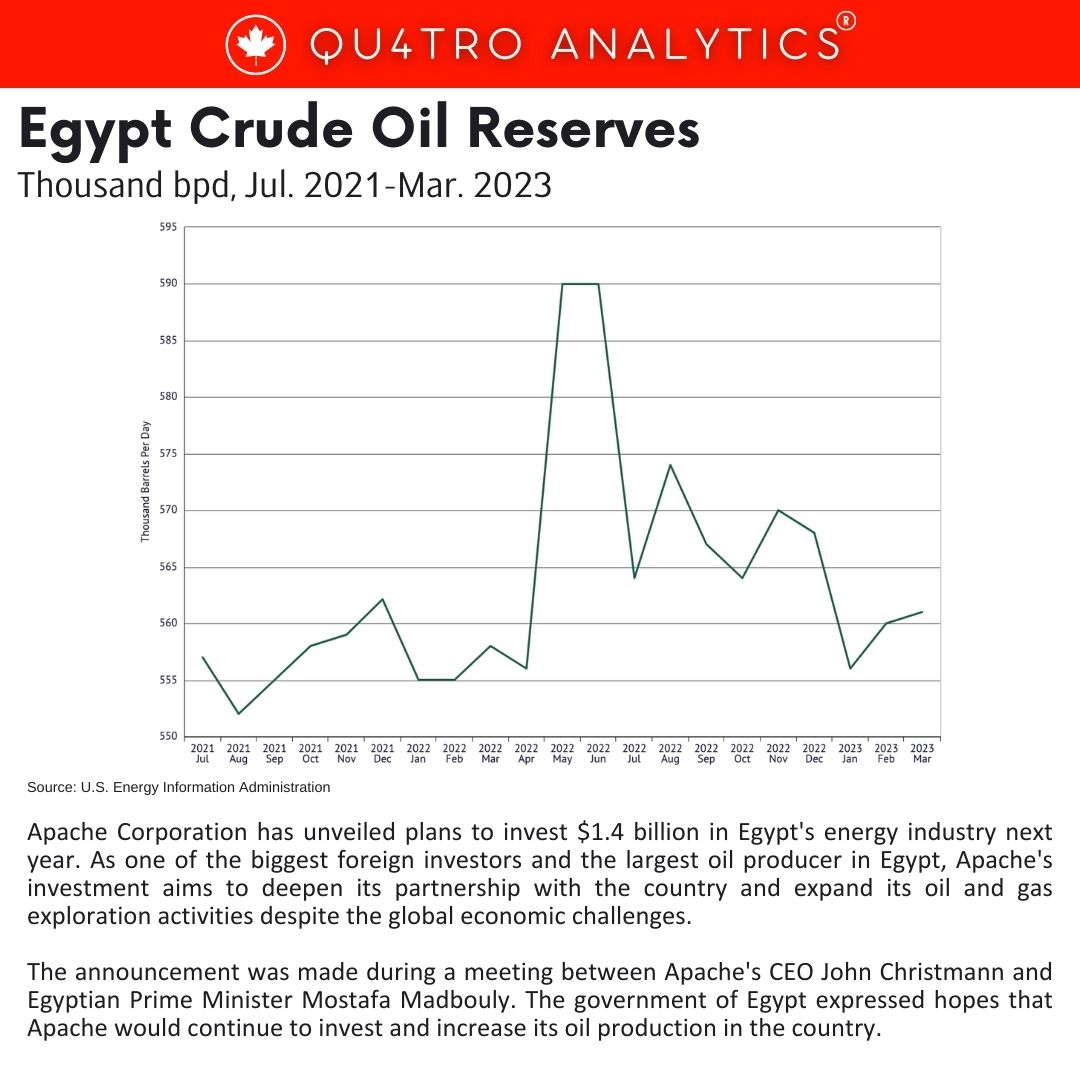

Apache Corporation has unveiled plans to invest $1.4 billion in Egypt’s energy industry next year. As one of the biggest foreign investors and the largest oil producer in Egypt, Apache’s investment aims to deepen its partnership with the country and expand its oil and gas exploration activities despite the global economic challenges.

The announcement was made during a meeting between Apache’s CEO John Christmann and Egyptian Prime Minister Mostafa Madbouly. The government of Egypt expressed hopes that Apache would continue to invest and increase its oil production in the country.

Apache has been operating in Egypt for more than 27 years and is a significant player in the country’s energy sector. With upgrades to its operations, Apache has managed to increase its oil production by 10% to over 150,000 barrels per day.

Apache has been operating in Egypt for more than 27 years and is a significant player in the country’s energy sector. With upgrades to its operations, Apache has managed to increase its oil production by 10% to over 150,000 barrels per day.

The company primarily focuses on the Western Desert region of Egypt, with exploration targets in both new and existing acreage. The company holds around 5.3 million gross acres across six separate concessions, with 68% of its acreage considered undeveloped, offering future exploration and development opportunities.

The recent investment commitment from Apache is part of its ongoing efforts to strengthen its presence in Egypt and contribute to the country’s energy development goals.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.