U.S. imposes penalties on solar panel producers evading China tariffs

- August 19, 2023

- Posted by: Quatro Strategies

- Categories: China, Sanctions & Regulation, United States

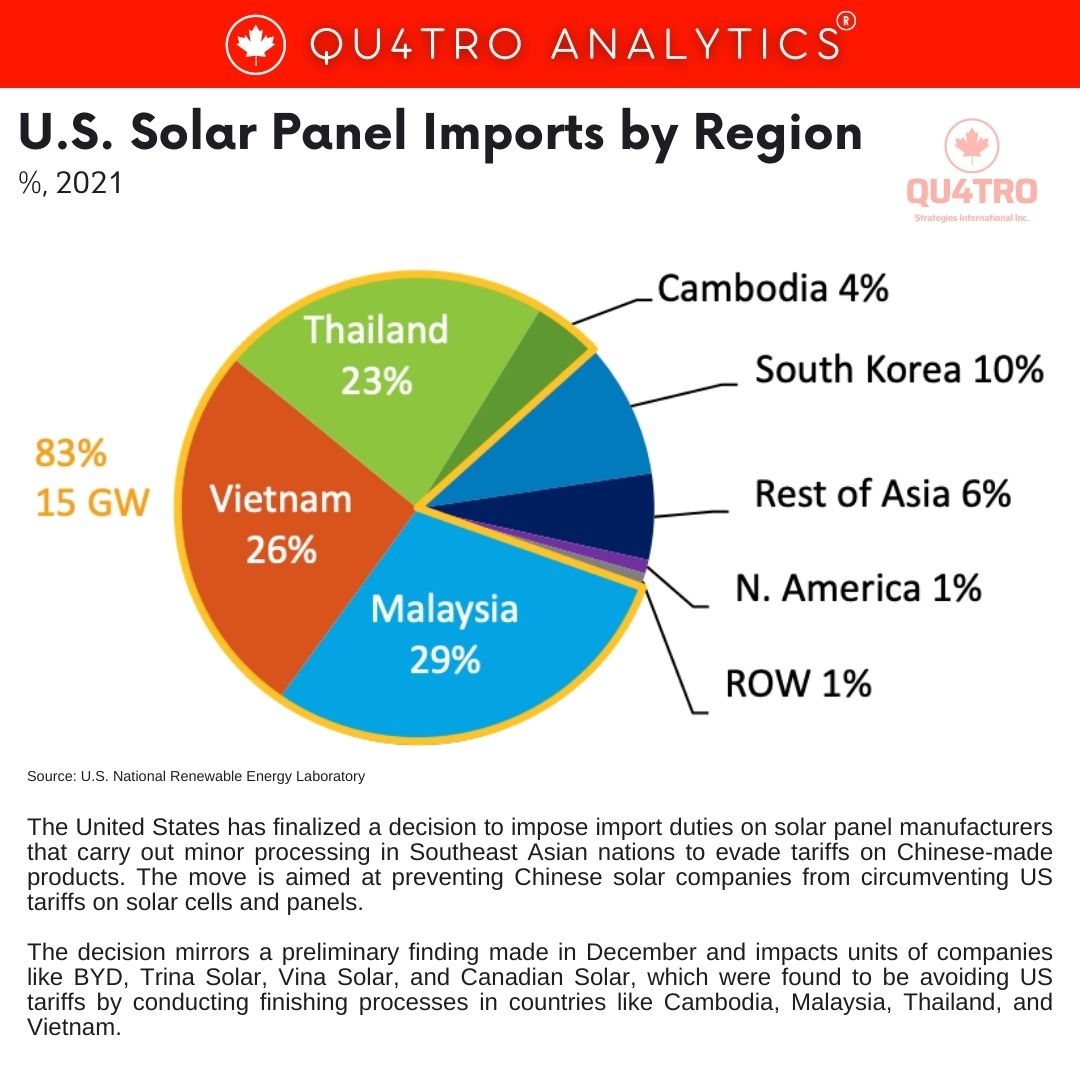

The United States has finalized a decision to impose import duties on solar panel manufacturers that carry out minor processing in Southeast Asian nations to evade tariffs on Chinese-made products. The move is aimed at preventing Chinese solar companies from circumventing US tariffs on solar cells and panels. The decision mirrors a preliminary finding made in December and impacts units of companies like BYD, Trina Solar, Vina Solar, and Canadian Solar, which were found to be avoiding US tariffs by conducting finishing processes in countries like Cambodia, Malaysia, Thailand, and Vietnam.

The Commerce Department’s decision is viewed as beneficial for the small US solar manufacturing industry, which has struggled to compete with cheap Chinese goods. However, it has raised concerns among solar panel buyers who rely on affordable imported products to make their projects economically viable.

The decision is part of efforts to level the playing field for domestic solar manufacturers and prevent tariff evasion. The United States has had anti-dumping duties on Chinese-made solar products for a decade due to unfair government subsidies. The recent decision will impose the same duty rates on solar products finished in Southeast Asian countries. However, these duties will only go into effect from June 2024 due to a two-year waiver granted by President Biden to ensure sufficient panel supplies while domestic manufacturing capacity grows.

The decision is part of efforts to level the playing field for domestic solar manufacturers and prevent tariff evasion. The United States has had anti-dumping duties on Chinese-made solar products for a decade due to unfair government subsidies. The recent decision will impose the same duty rates on solar products finished in Southeast Asian countries. However, these duties will only go into effect from June 2024 due to a two-year waiver granted by President Biden to ensure sufficient panel supplies while domestic manufacturing capacity grows.

Critics of the decision, including the solar industry, argue that it could impede the growth of solar manufacturing spurred by the Biden administration’s clean energy policies. They believe that the Commerce Department’s move might increase costs for solar products at a time when demand for solar energy is rising.

Trina Solar, which has invested heavily in cell and module production in countries like Thailand and Vietnam, criticized the decision, stating that it would raise costs for US-bound solar products and limit supply when demand is strong. This situation underscores the complexities and challenges faced by the solar industry as it balances trade dynamics, domestic manufacturing interests, and environmental goals.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.