U.S. to cancel Trump-era Alaska oil and gas leases

- September 7, 2023

- Posted by: Quatro Strategies

- Categories: Oil & Gas, Sanctions & Regulation, United States

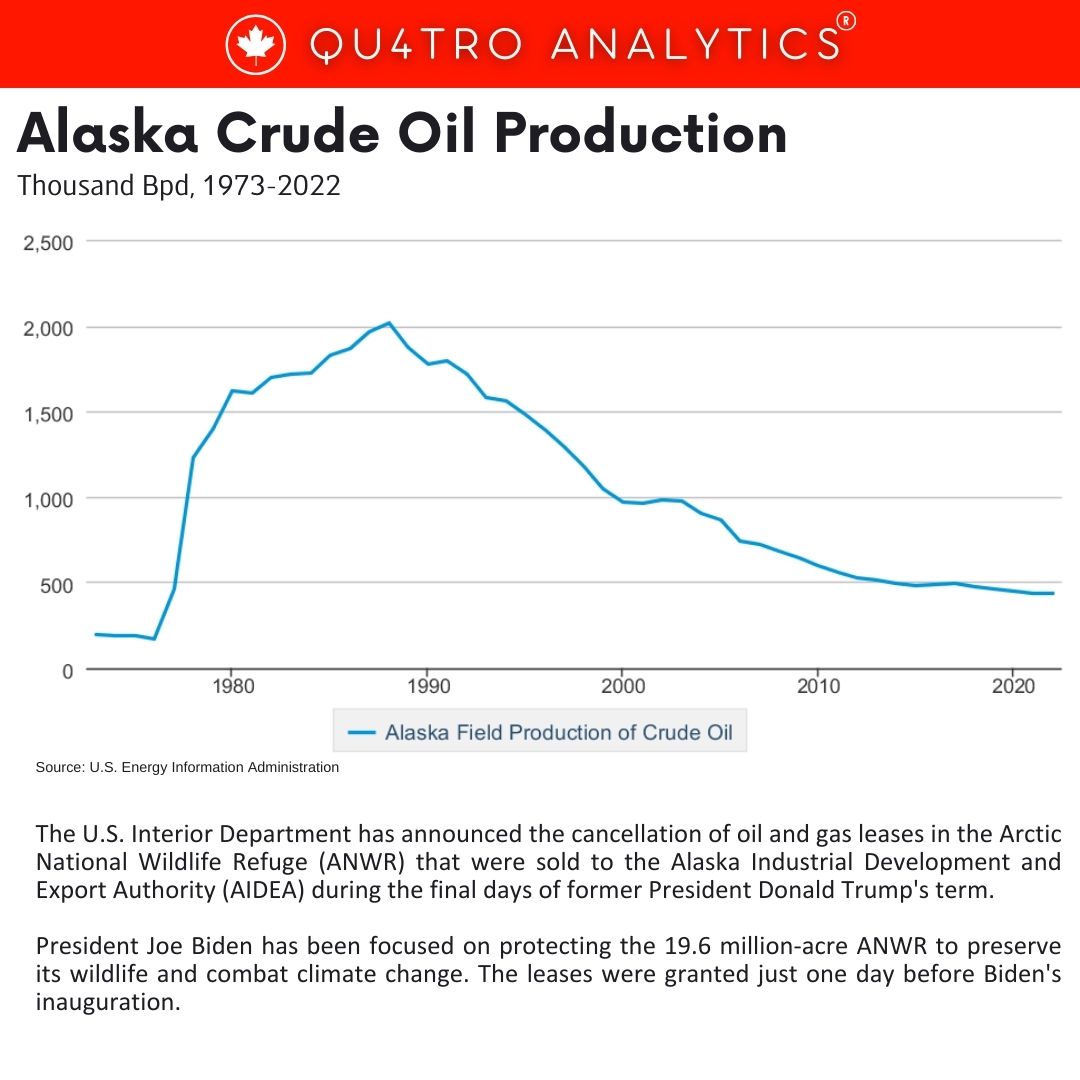

The U.S. Interior Department has announced the cancellation of oil and gas leases in the Arctic National Wildlife Refuge (ANWR) that were sold to the Alaska Industrial Development and Export Authority (AIDEA) during the final days of former President Donald Trump’s term. President Joe Biden has been focused on protecting the 19.6 million-acre ANWR to preserve its wildlife and combat climate change.

The leases were granted just one day before Biden’s inauguration.

This decision has been applauded by environmentalists but criticized by some Alaskan officials who sought to open up drilling in the reserve to secure jobs and revenues for the state. It’s part of Biden’s broader agenda to limit oil and gas activities on public lands to address climate change.

The Interior Department will also prohibit new leasing on over 10 million acres in the National Petroleum Reserve in Alaska, the largest undisturbed public land in the United States. This move represents another step in Biden’s effort to combat climate change by reducing oil and gas production on public lands.

The Interior Department will also prohibit new leasing on over 10 million acres in the National Petroleum Reserve in Alaska, the largest undisturbed public land in the United States. This move represents another step in Biden’s effort to combat climate change by reducing oil and gas production on public lands.

However, it’s worth noting that Biden is also under pressure to ensure domestic fuel supplies and keep pump prices low. Earlier this year, his administration approved a $7 billion ConocoPhillips drilling project in Alaska, which drew criticism from the United Nations for not aligning with efforts to transition away from fossil fuels.

AIDEA has stated that it will challenge the cancellation of the leases in court, arguing that the Interior Department’s decision is based on campaign rhetoric and disregards federal law.

This decision marks the latest development in the ongoing debate over drilling and environmental protection in Alaska’s sensitive ecosystems, and it reflects the Biden administration’s commitment to addressing climate change by curbing fossil fuel extraction on federal lands.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.