UAE, Malaysia partnering to establish 10GW renewable capacity in Malaysia

- October 6, 2023

- Posted by: Quatro Strategies

- Categories: Asia Pacific, ESG & Renewable Energy, Middle East

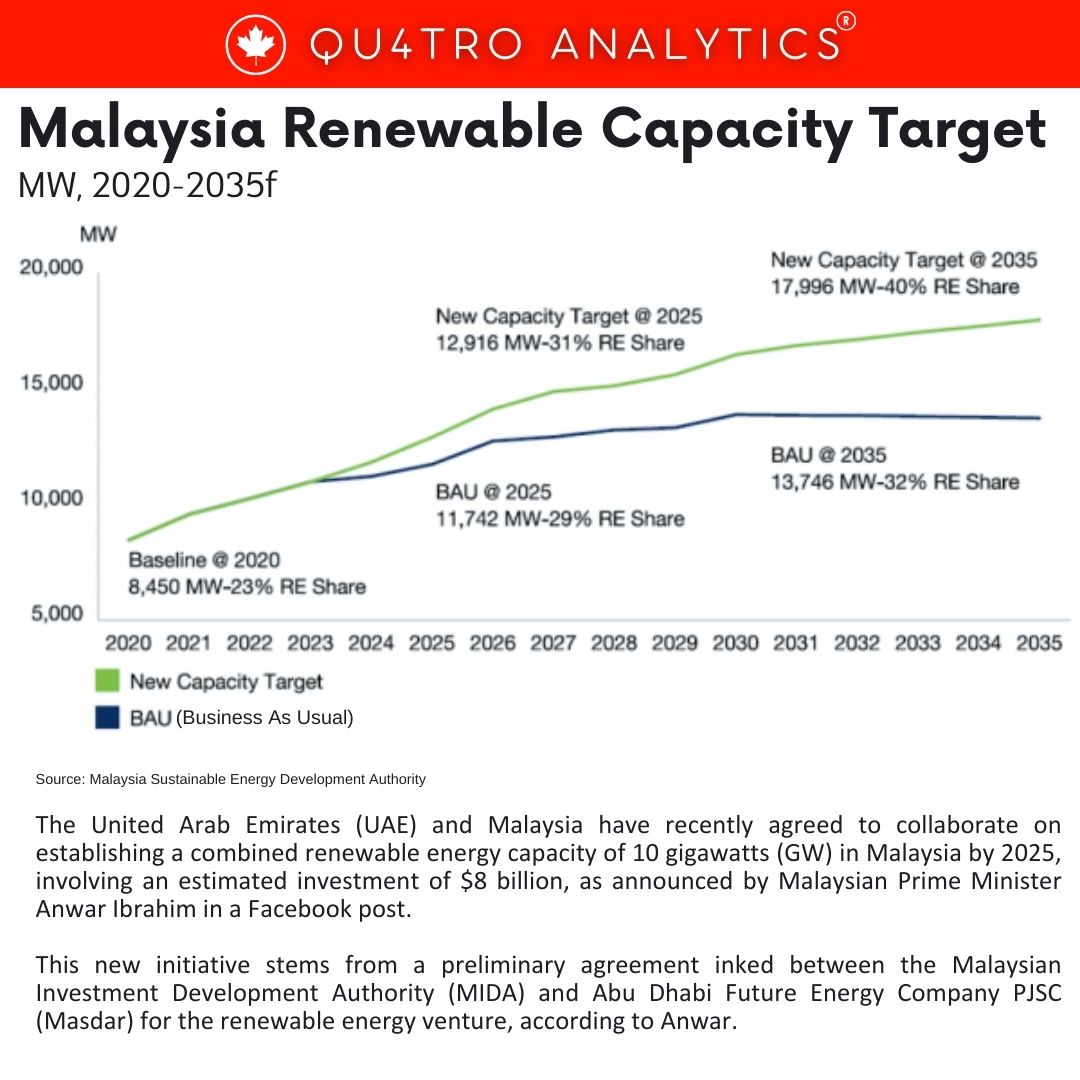

The United Arab Emirates (UAE) and Malaysia have recently agreed to collaborate on establishing a combined renewable energy capacity of 10 gigawatts (GW) in Malaysia by 2025, involving an estimated investment of $8 billion, as announced by Malaysian Prime Minister Anwar Ibrahim in a Facebook post.

This new initiative stems from a preliminary agreement inked between the Malaysian Investment Development Authority (MIDA) and Abu Dhabi Future Energy Company PJSC (Masdar) for the renewable energy venture, according to Anwar.

During his visit to the UAE, Anwar engaged with representatives from 21 major corporations, including notable entities such as the Abu Dhabi National Oil Company (ADNOC), the Abu Dhabi National Energy Company (TAQA), Masdar, Al-Dahra, Lulu, DP World, the Abu Dhabi Investment Authority (ADIA), and Mubadala.

Furthermore, Anwar held discussions with UAE President Sheikh Mohamed bin Zayed Al Nahyan, focusing on enhancing the existing bilateral cooperation between the UAE and Malaysia, especially in economic, trade, and investment realms, alongside renewable energy, food security, and other areas crucial for both nations’ pursuits of a sustainable and prosperous future.

Anwar mentioned, “I am informed that many of those who have invested in Malaysia are eager to add to existing investments, including the UAE International Investors Council and the Abu Dhabi and Dubai Chambers of Commerce.”

Anwar mentioned, “I am informed that many of those who have invested in Malaysia are eager to add to existing investments, including the UAE International Investors Council and the Abu Dhabi and Dubai Chambers of Commerce.”

In May, the UAE and Malaysia made a decision to commence bilateral trade negotiations for a Comprehensive Economic Partnership Agreement (CEPA), a pursuit the UAE has been engaged in with various countries since 2021.

Over recent years, the two countries have witnessed an upswing in bilateral investments. As of May, Malaysian investments in the UAE reached $150 million, while UAE investments in Malaysia amounted to $220 million, according to UAE Trade Minister Thani Ahmed Al Zeyoudi.

Al Zeyoudi emphasized, “The UAE is Malaysia’s 17th trade partner globally and the second in the Middle East, constituting 32% of Malaysia’s trade with Arab countries. The UAE is also the primary destination for Malaysian merchandise exports to Arab countries,” as conveyed in a statement to WAM in May.

In the upcoming months, the UAE is preparing to host the 2023 UN Climate Change Conference, scheduled to take place in Dubai between November 30 and December 12, marking the 28th meeting of the Conference of the Parties (COP 28).

QUATRO Strategies International Inc. is the leading business insights and corporate strategy company based in Toronto, Ontario. Through our unique services, we counsel our clients on their key strategic issues, leveraging our deep industry expertise and using analytical rigor to help them make informed decisions to establish a competitive edge in the marketplace.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.