U.S. set to ban certain investments in China regarding sensitive technologies

- August 20, 2023

- Posted by: Quatro Strategies

- Categories: AI & Semiconductors, China, United States

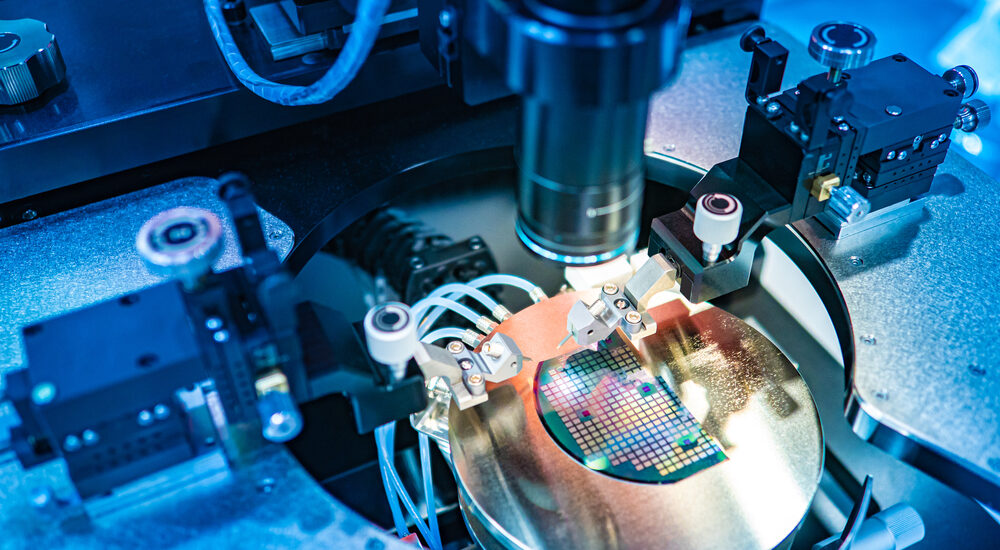

President Joe Biden has signed an executive order that restricts certain new U.S. investments in China, particularly in sensitive technology sectors such as semiconductors, microelectronics, quantum information technologies, and specific artificial intelligence systems. The order allows the U.S. Treasury Secretary to prohibit or limit investments in Chinese entities operating within these areas. The intention behind this move is to prevent American capital and expertise from aiding China in developing technologies that could potentially support its military advancements and threaten U.S. national security. The executive order targets various forms of investment, including private equity, venture capital, joint ventures, and greenfield investments.

The action is rooted in concerns about China’s growing technological capabilities and its potential implications for global security. Tensions between the U.S. and China, particularly in the tech sector, have escalated in recent years. The U.S. government aims to protect critical technologies and prevent their unintended use to strengthen China’s military capabilities. It also seeks to ensure that sensitive technology is not diverted away from U.S. national security interests.

The executive order is designed to address specific sectors within the broader technological landscape, and its impact is still unfolding. It is open for public input, indicating a willingness to consider feedback before implementing specific restrictions. The executive order follows consultations with U.S. allies and incorporates feedback from the Group of Seven (G7) nations, reflecting an attempt to build a cohesive approach to address these concerns.

China has expressed strong opposition to the order, indicating that it sees the move as harmful to economic cooperation and global trade exchanges. The Chinese government has warned against creating obstacles to economic recovery and damaging the international economic and trade order.

The order is part of a broader effort to manage the complex relationship between the U.S. and China, which includes economic, political, and security dimensions. While it is aimed at safeguarding U.S. interests, it also has implications for global economic dynamics, trade relationships, and technological competition. The focus on specific sectors like semiconductors highlights the strategic importance of certain technologies in modern warfare and defense capabilities.

The move to restrict investments in sensitive technology sectors represents one facet of the multifaceted U.S.-China relationship, and it will likely prompt further discussions about how to balance economic interests with national security concerns. As geopolitical tensions continue to shape international relations, particularly between these two global superpowers, strategic actions like this executive order will continue to evolve and influence the broader landscape of global technology, trade, and security.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.